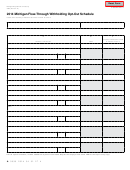

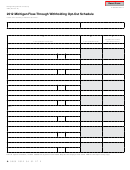

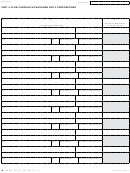

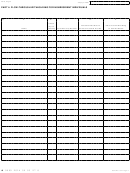

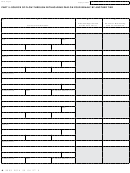

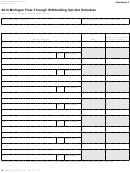

Form 4918 To 4920 - Michigan Flow-Through Withholding - 2014 Page 6

ADVERTISEMENT

Print the name of the authorized signer and preparer in the

appropriate area on the return.

Assemble the returns and attachments (in sequence order) and

staple in the upper-left corner. (Do not staple a check to the

return.)

IMPORTANT REMINDER: Failure to include all the

required forms and attachments will delay processing and may

result in reduced or denied refund or a bill for tax due.

Mailing Addresses

Mail the annual return and all necessary schedules to:

With payment:

Michigan Department of Treasury

PO Box 30806

Lansing MI 48909

Without payment:

Michigan Department of Treasury

PO Box 30805

Lansing MI 48909

Make all checks payable to “State of Michigan.” Print

taxpayer’s Federal Employer Identification Number (FEIN), the

tax year, and “FTW” on the front of the check. Do not staple

the check to the return.

Correspondence

Address changes and business discontinuance can be reported

by using the Notice of Change or Discontinuance (Form 163),

which can be found at

Mail correspondence to:

Michigan Department of Treasury

Customer Contact Division — FTW Unit

PO Box 30769

Lansing MI 48909

To Request Forms

Internet

Current and past year forms are available on Treasury’s Web

site at

Alternate Format

Printed material in an alternate format may be obtained by

calling (517) 636-6925.

TTY

Assistance is available using TTY through the Michigan Relay

Center by calling 1-800-649-3777 or 711.

6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32