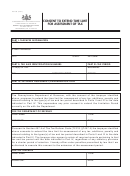

Item 4. Indicate if major addition is in accordance with Section 40-9B-3(11)

Column 18.

18a. Enter all costs or value for project land. If land is donated, enter the

requirement as denoted above. If major addition does not meet threshold

requirement, project is not qualified to receive abatement. Original cost

should include the total cost of existing facilities as of the date of

market value of the land.

18b. Enter all costs or value for existing building(s), if any.

application.

Item 5. Enter the name of the private user requesting abatement. If project

18c. Enter all costs or value for existing personal property to be incorpo-

is doing business under another name, also enter the name of the compa-

ny under "Doing Business As (DBA)."

rated into project. Only personal property not previously placed in service

Item 6. Enter the address of the private user requesting abatement.

in Alabama by the private user or a related party can be included. If a pri-

vate user is including existing equipment from outside of Alabama, the

Item 7. Enter the name and telephone number of the person to which all

existing equipment should be entered here at its original cost.

18d. Enter the total cost for new building(s) and/or new additions to exist-

correspondence should be directed regarding the abatement.

Item 8. Enter the date the company was organized.

ing building(s). Total cost includes building materials, construction costs,

engineering costs, etc. Costs associated with renovating or remodeling

Item 9. Enter the physical location of the project. Please include a detailed

existing facilities of an operating industrial or research enterprise do not

qualify for abatement.

18e. Enter the total cost for new manufacturing equipment to be incorpo-

location, including the City, County and Zip Code.

Item 10. Describe the type of business that the project will be engaged in.

rated into the project. Replacement equipment does not qualify for abate-

For projects that do not require a NAICS code, provide a detailed descrip-

ment. New equipment that is defined as upgraded equipment may qualify.

tion that will identify the activities as qualifying activities. Attach additional

Upgraded equipment is equipment that replaces existing equipment, and

sheets if necessary.

performs not only the same functions, but also an additional function.

Item 11. Enter the estimated date the construction of the project will begin.

18f. Enter the total cost for all other new personal property. Other new per-

Item 12. Enter the estimated date the construction of the project will be

sonal property may include, but is not limited to, non-manufacturing

machinery, office equipment, computers, vehicles, etc. Only personal prop-

completed.

erty that is a depreciable item can be included.

Item 13. Enter the estimated date the project will be placed in service. If

18g. Add 18a through 18f and enter total here. This is the total amount on

revenue bonds are issued, "placed in service," for property tax purposes,

which the initial property taxes will be based. This total must be the total

is determined as of the date of the initial issuance of such bonds.

value of the cost or investment in the project. This total must agree with the

Otherwise, "placed in service" for sales and use tax and property tax pur-

total investment amount in the abatement resolution and the total invest-

poses is determined as the later of 1) the date on which title to the proper-

ment amount in the abatement agreement.

Column 19.

ty was acquired by or vested in a county, city, or public authority, or 2) the

date on which the property is or becomes owned, for federal income tax

19d. Enter the cost of the building materials (subject to sales tax) that

purposes, by a private user.

Item 14. Indicate if bonds have been issued in financing the project.

become a part of realty for new building(s) and/or new additions to existing

If bonds have been issued, enter the issuance date. If bonds have not been

building(s). Other building costs (labor, engineering) are not subject to

issued, proceed to Column 16.

sales tax.

Item 15. Indicate if bonds will be issued for financing the project. If bonds

19e. Enter the cost of new manufacturing equipment for the project. For

will be issued, enter the projected issuance date.

sales tax purposes, manufacturing equipment is taxed at a lower rate.

Column 16. Enter the estimated number of new employees to be hired at

Equipment that is purchased used from another company in an isolated

transaction is not subject to sales tax and should not be included.

19f. Enter the cost of all other new personal property.

the project. The law requires the number of employees to be employed at

the project initially and in each of the succeeding three years.

Column 17. Enter the estimated annual payroll for employees at the pro-

19g. Add 19d through 19f and enter total here.

ject. The law requires the estimated payroll of new employees initially and

in each of the succeeding three years.

1

1 2

2 3

3