RESET

PRINT

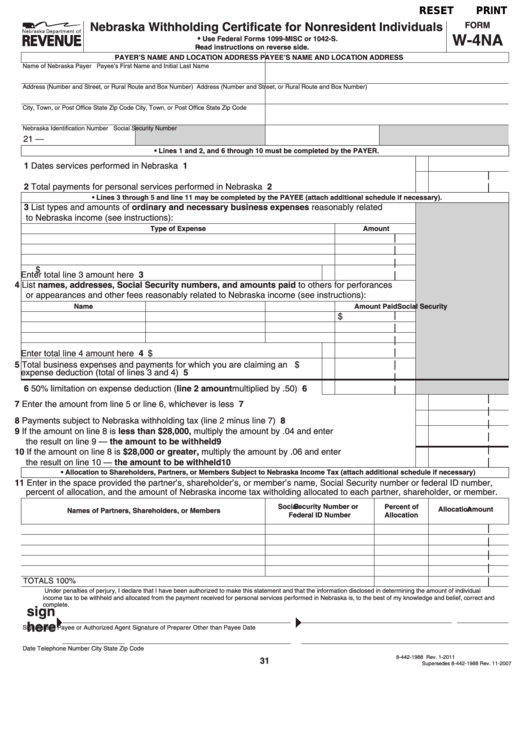

Nebraska Withholding Certificate for Nonresident Individuals

FORM

W-4NA

•

Use Federal Forms 1099-MISC or 1042-S.

• Read instructions on reverse side.

PAYER’S NAME AND LOCATION ADDRESS

PAYEE’S NAME AND LOCATION ADDRESS

Name of Nebraska Payer

Payee’s First Name and Initial

Last Name

Address (Number and Street, or Rural Route and Box Number)

Address (Number and Street, or Rural Route and Box Number)

City, Town, or Post Office

State

Zip Code

City, Town, or Post Office

State

Zip Code

Nebraska Identification Number

Social Security Number

21 —

• Lines 1 and 2, and 6 through 10 must be completed by the PAYER.

1 Dates services performed in Nebraska .................................................................................................. 1

2 Total payments for personal services performed in Nebraska .............................................................. 2

• Lines 3 through 5 and line 11 may be completed by the PAYEE (attach additional schedule if necessary).

3 List types and amounts of ordinary and necessary business expenses reasonably related

to Nebraska income (see instructions):

Type of Expense

Amount

$

Enter total line 3 amount here ........................................................................

3

4 List names, addresses, Social Security numbers, and amounts paid to others for perforances

or appearances and other fees reasonably related to Nebraska income (see instructions):

Name

Address

Social Security No.

Amount Paid

$

4 $

Enter total line 4 amount here ........................................................................

5 Total business expenses and payments for which you are claiming an

$

5

expense deduction (total of lines 3 and 4) ......................................................

6 50% limitation on expense deduction (line 2 amount multiplied by .50) .......

6

7 Enter the amount from line 5 or line 6, whichever is less ...................................................................... 7

8 Payments subject to Nebraska withholding tax (line 2 minus line 7) ..................................................... 8

9 If the amount on line 8 is less than $28,000, multiply the amount by .04 and enter

the result on line 9 — the amount to be withheld ................................................................................ 9

10If the amount on line 8 is $28,000 or greater, multiply the amount by .06 and enter

the result on line 10 — the amount to be withheld .............................................................................. 10

• Allocation to Shareholders, Partners, or Members Subject to Nebraska Income Tax (attach additional schedule if necessary)

11Enter in the space provided the partner’s, shareholder’s, or member’s name, Social Security number or federal ID number,

percent of allocation, and the amount of Nebraska income tax witholding allocated to each partner, shareholder, or member.

Social Security Number or

Percent of

Allocation Amount

Names of Partners, Shareholders, or Members

Federal ID Number

Allocation

TOTALS

100%

Under penalties of perjury, I declare that I have been authorized to make this statement and that the information disclosed in determining the amount of individual

income tax to be withheld and allocated from the payment received for personal services performed in Nebraska is, to the best of my knowledge and belief, correct and

complete.

sign

here

Signature of Payee or Authorized Agent

Signature of Preparer Other than Payee

Date

Date

Telephone Number

City

State

Zip Code

8-442-1988 Rev. 1-2011

31

Supersedes 8-442-1988 Rev. 11-2007

1

1 2

2