Schedule N Incentives - Attachment To The Form 480.30(Ii) - Partially Exempt Income Under Act 8 Of 1987 - 2003

ADVERTISEMENT

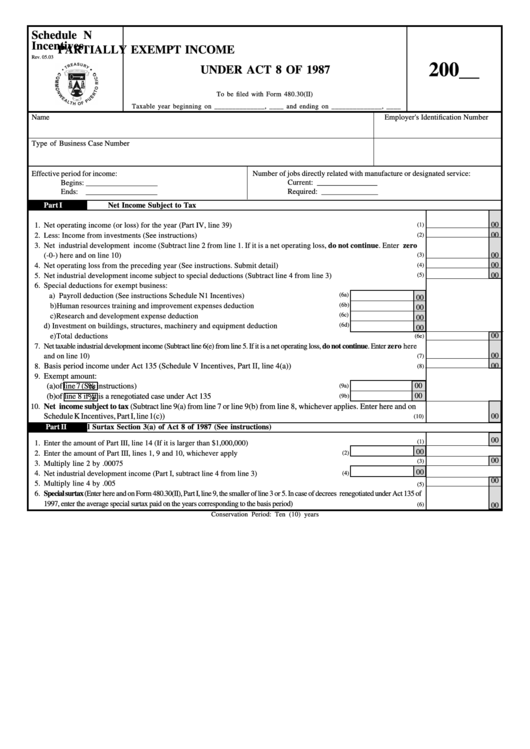

Schedule N

Incentives

PARTIALLY EXEMPT INCOME

Rev. 05.03

200__

UNDER ACT 8 OF 1987

To be filed with Form 480.30(II)

Taxable year beginning on ______________, ____ and ending on ______________, ____

Name

Employer's Identification Number

Type of Business

Case Number

Effective period for income:

Number of jobs directly related with manufacture or designated service:

Current: ________________

Begins: ___________________

Ends: ___________________

Required: _______________

Part I

Net Income Subject to Tax

00

1.

Net operating income (or loss) for the year (Part IV, line 39) ............................................................................................

(1)

00

2.

Less: Income from investments (See instructions) .............................................................................................................

(2)

3.

Net industrial development income (Subtract line 2 from line 1. If it is a net operating loss, do not continue. Enter zero

00

(-0-) here and on line 10) ....................................................................................................................................................

(3)

4.

Net operating loss from the preceding year (See instructions. Submit detail) ....................................................................

(4)

00

00

5.

Net industrial development income subject to special deductions (Subtract line 4 from line 3) .........................................

(5)

6.

Special deductions for exempt business:

a) Payroll deduction (See instructions Schedule N1 Incentives) ..............................................

(6a)

00

(6b)

b) Human resources training and improvement expenses deduction ........................................

00

(6c)

c) Research and development expense deduction ....................................................................

00

(6d)

d) Investment on buildings, structures, machinery and equipment deduction ..........................

00

00

e) Total deductions .........................................................................................................................................................

(6e)

7.

Net taxable industrial development income (Subtract line 6(e) from line 5. If it is a net operating loss, do not continue. Enter zero here

00

and on line 10) ....................................................................................................................................................................

(7)

Basis period income under Act 135 (Schedule V Incentives, Part II, line 4(a)) ............................................................

00

8.

(8)

9.

Exempt amount:

%

00

(a)

of line 7 (See instructions) ........................................................................

(9a)

00

(b)

of line 8 if it is a renegotiated case under Act 135 .....................................

(9b)

%

10.

Net income subject to tax (Subtract line 9(a) from line 7 or line 9(b) from line 8, whichever applies. Enter here and on

Schedule K Incentives, Part I, line 1(c)) ............................................................................................................................

00

(10)

Part II

Special Surtax Section 3(a) of Act 8 of 1987 (See instructions)

00

(1)

1.

Enter the amount of Part III, line 14 (If it is larger than $1,000,000).....................................................

00

2.

Enter the amount of Part III, lines 1, 9 and 10, whichever apply ....................................................

(2)

00

(3)

3.

Multiply line 2 by .00075 .....................................................................................................................

00

4.

Net industrial development income (Part I, subtract line 4 from line 3) ..........................................

(4)

00

5.

Multiply line 4 by .005 ............................................................................................................................................................

(5)

6.

Special surtax (Enter here and on Form 480.30(II), Part I, line 9, the smaller of line 3 or 5. In case of decrees renegotiated under Act 135 of

1997, enter the average special surtax paid on the years corresponding to the basis period) ...........................................................................

(6)

00

Conservation Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2