Keystone Opportunity Zone - Program Guidelines And Application - Pennsylvania Department Of Community And Economic Development Page 12

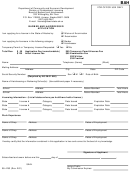

ADVERTISEMENT

Application Number

For Department Use

20

Keystone Opportunity Zone (KOZ)

pennsylvania

PA

Application

D E P A R T M E N T O F C O M M U N I T Y

E C O N O M I C D E V E L O P M E N T

&

* Indicates required field

c Real Property Owner

c Business

c Resident

1. *Is this application for benefits for a

:

(check all that apply)

2. *Name of Real Property Owner/Business/Resident:

3. CEO or President of Business:

4. *KOZ Address of Business/Resident/Property Owner:

City:

State:

Zip:

5. *Municipality:

County:

County Code#:

*School District:

School District Code#:

6. Property Tax Parcel ID Number(s), if applicable:

7. *Mailing Address

:

(where correspondence concerning KOZ issues should be mailed)

City:

State:

Zip:

8. *Contact Name:

Telephone #:

Fax #:

E-mail address:

9. SS Number

: __ __ __ - __ __ - __ __ __ __

(i.e. property owner, resident or sole proprietorship)

Spouse’s SS Number: __ __ __ - __ __ - __ __ __ __

10. Tax ID Numbers: (MUST be provided, if applicable)

EIN __ __ - __ __ __ __ __ __ __ Sales Tax __ __ - __ __ __ __ __ __ Employer Acct

. (not EIN)

Corporate Box:

Utility PURTA :

Unemployment Compensation:

11. Business Only: Indicate how your entity reports to the Internal Revenue Service (Check type of entity):

c LLC

c C Corp

c S Corp

c Non-Profit

c Partnership

c Trust/Estate

is the LLC a:

c Partnership: Form 1065

c C Corporation: Form 1120

c S Corporation: Form 1120S

c Disregarded Entity (Corporate): Form 1120

c Disregarded Entity (Sole Proprietorship): Form 1040

Other

:

(please specify type)

9

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17