Keystone Opportunity Zone - Program Guidelines And Application - Pennsylvania Department Of Community And Economic Development Page 4

ADVERTISEMENT

Section I – General

A. Introduction

The Keystone Opportunity Zone (KOZ) Program is one of the nation’s boldest, and innovative economic

and community development programs. This unique program develops a community’s abandoned, unused,

underutilized land and buildings into business districts and residential areas that present a well-rounded and

well-balanced approach to community revitalization. The Department of Community and Economic

Development administers this partnership between state and local government in collaboration with the

Department of Revenue (state taxes) and the Department of Labor and Industry (Unemployment Compen-

sation taxes), based on the Keystone Opportunity Zone and Keystone Opportunity Expansion Zone Act, 73

P.S. §§820.101- 820.1309 (the “Act”).

The Keystone Opportunity Zones are designated by the local communities and approved by the State. The

Keystone Opportunity Improvement Zones were designated by Executive Order, of the Governor, and

approved by the local communities. All Keystone Opportunity Zones are virtually tax free. Keystone

Opportunity Zones entitle businesses and residents to certain tax benefits when they locate in a Keystone

Opportunity Zone. Keystone Opportunity Zones consist of 12 defined areas in 61 counties across Pennsyl-

vania, covering more than 49,000 acres in over 193 sub-zones. Sizes of the KOZ range from under 10 acres

to over 500. Along with the remarkable tax advantages, these areas provide close proximity to major inter-

states, ports, rail lines and international airports.

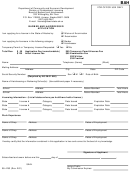

B. Program Qualifications

1. Business: A business must own or lease real property in a KOZ and actively conduct a trade,

profession or business from the property and remain compliant with state and local tax laws and

building codes. Existing businesses that are expanding, new businesses and out-of-state businesses

moving into Pennsylvania need only move into a KOZ, file a one page annual application for benefits

and submit the application with a synopsis of the business, which contains a description of the

business, job creation potential and the anticipated capital investment.

2. Relocation: An existing Pennsylvania business relocating into a KOZ must meet one of the relocation

provisions of the Act. (See section D)

3. Recapture: Any qualified business that has received KOZ benefits and moves out of the zone within

the first 5 years may be subject to penalties.

4. Property Owner Qualifications: Please be advised that you must apply annually to the Department in

order to receive approval for property tax abatement, as required by Section 907 of the Act. If you are

found to be noncompliant with any tax or zoning requirements during the (2004) calendar year, your

KOZ status will be revoked and you may be subject to penalties and/or recapture under the Act.

5. Resident Qualifications: Residents must maintain compliance with all state and local tax laws. They

must reside 184 consecutive days, in the KOZ during each tax year.

All KOZ applicants must file an annual application with the Department.

The KOZ Change of Status Notification must be submitted, to the Department, if a change takes place.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17