Keystone Opportunity Zone - Program Guidelines And Application - Pennsylvania Department Of Community And Economic Development Page 7

ADVERTISEMENT

E. Eligibility for Other Department Programs

Keystone Opportunity Zone benefit recipients may be eligible for other programs administered by the

Department of Community and Economic Development. The Department’s Single Application for Assis-

tance can be completed to apply for financial assistance from the Department’s various funding sources.

The Department encourages you to visit our web site and submit your Single Application for Assistance via

on-line submission at In addition, you may call the Department’s Customer Service

Center at 1-800-379-7448, or your local KOZ Regional Coordinator (see attachment II).

Section II – The Application Process

A. General

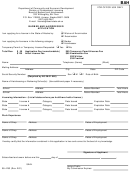

1. KOZ Applications for completion by applicants that are property owners, businesses and residents and

guidelines to assist with the completion of the KOZ Application may be accessed in the following

manner;

a. Applications should be completed on line. The guidelines, to assist with the completion of the

application may also be viewed on line. The Application and Guidelines can be accessed by going

to and following the prompts to the KOZ web page. Your completed

application will be electronically submitted to the Department, and your local coordinator.

b. All questions marked with an asterisk must be completed on every application.

c. If you wish to obtain a paper copy of the application and guidelines please contact the Department's

Customer Service Center at 1-800-379-7448. Please return the completed application to the

Department.

2. Applicants must file an annual application by December 31 of the year for which they are applying for

benefits to maintain eligibility for KOZ benefits.

B. Approval Process

1. Applicants must apply on an annual basis to maintain eligibility for KOZ benefits.

2. The Local Coordinator will determine compliance with local taxes and codes and forward the

application to the state within 15 business days of receipt of the application, whether or not the

application is compliant locally.

3. The Department of Community and Economic Development will assign an official KOZ file number

and forward the application to the Department of Revenue to check state tax compliance and to the

Department of Labor and Industry for Unemployment Compensation tax compliance.

4. No qualified business may claim or receive an exemption, deduction, abatement or credit under this act

unless that qualified business in full compliance with all state and local tax laws, ordinances and

resolutions.

5. No qualified business may claim or receive an exemption, deduction, abatement or credit under this act

if any person or business with a 20% interest or greater interest in that qualified business is not in full

compliance with all State and local tax laws, ordinances and resolutions.

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17