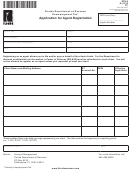

Form 8957 (Rev. 10-2015)

3

Page

11a

The Financial Institution's RO will be a point of contact (POC) for the Financial Institution. In addition, the RO of a Financial Institution

registering as a Lead of all or part of an Expanded Affiliated Group will be a POC for each Member of that group.

Does the RO or an Authorizing Individual wish to designate one or more additional POCs for the Financial Institution?

Yes (If “Yes,” complete line 11b)

No (If “No,” go to line 12)

b

This line 11b must be completed by the Financial Institution's RO or an Authorizing Individual. Upon entering the POC information

below, checking the box that follows, and submitting this registration form, the RO or Authorizing Individual is providing the IRS with

written authorization to release FATCA information to the POC. This authorization specifically includes authorization for the POC to

complete this Form 8957: FATCA Registration, to take other FATCA-related actions, and to obtain access to the Financial Institution's

tax information.

Business Title of POC

Legal Name of POC

Last (Family)

First (Given)

Middle

City

Country/Jurisdiction

Business Address Line 1

Business Address Line 2

State/Province/Region

ZIP/Postal Code

Business Telephone Number

Business Fax Number

Business Email Address of POC

Five POCs are allowed per Financial Institution. Use additional sheets to add POCs.

By checking this box, I,

, as RO or Authorizing Individual for the Financial Institution, provide the authorization

described above to the identified POCs listed in this line 11b. Once this authorization is granted, it is effective until revoked by either

the Financial Institution or the POC.

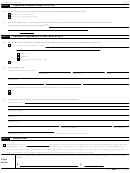

Part 2

Expanded Affiliated Group

Lead Financial Institutions must read the instructions before completing Part 2.

12

Provide the following for each Financial Institution member of the Expanded Affiliated Group

of residence for tax

Legal name of Member Financial Institution

Country/Jurisdiction

Member type *

purposes

* Enter one of the following:

Participating Financial Institution not covered by an IGA; or a Reporting Financial Institution under a Model 2 IGA

Registered Deemed-Compliant Financial institution (including a Reporting Financial Institution under a Model 1 IGA)

Limited Financial Institution

8957

Form

(Rev. 10-2015)

1

1 2

2 3

3 4

4