Reset

Print

310:09 06 13

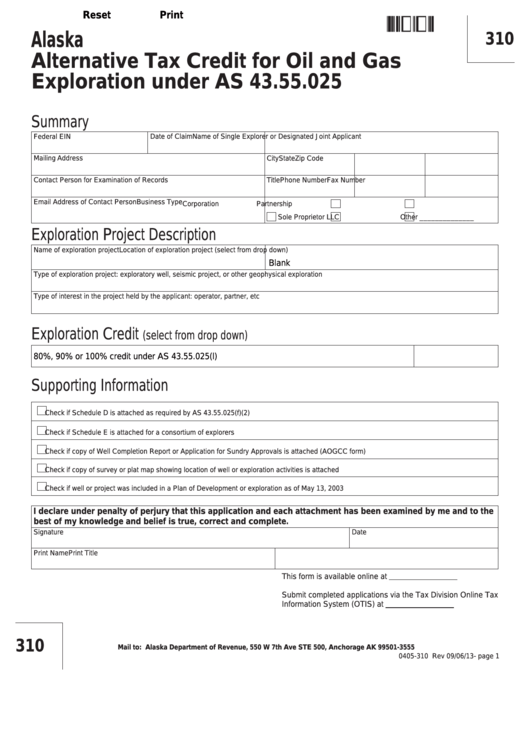

Alaska

310

Alternative Tax Credit for Oil and Gas

Exploration under AS 43.55.025

Summary

Federal EIN

Date of Claim

Name of Single Explorer or Designated Joint Applicant

Mailing Address

City

State

Zip Code

Contact Person for Examination of Records

Title

Phone Number

Fax Number

Email Address of Contact Person

Business Type

Corporation

Partnership

Sole Proprietor

LLC

Other ______________

Exploration Project Description

Name of exploration project

Location of exploration project (select from drop down)

Blank

Type of exploration project: exploratory well, seismic project, or other geophysical exploration

Type of interest in the project held by the applicant: operator, partner, etc

Exploration Credit

(select from drop down)

80%, 90% or 100% credit under AS 43.55.025(l)

Supporting Information

Check if Schedule D is attached as required by AS 43.55.025(f)(2)

Check if Schedule E is attached for a consortium of explorers

Check if copy of Well Completion Report or Application for Sundry Approvals is attached (AOGCC form)

Check if copy of survey or plat map showing location of well or exploration activities is attached

Check if well or project was included in a Plan of Development or exploration as of May 13, 2003

I declare under penalty of perjury that this application and each attachment has been examined by me and to the

best of my knowledge and belief is true, correct and complete.

Signature

Date

Print Name

Print Title

This form is available online at

Submit completed applications via the Tax Division Online Tax

Information System (OTIS) at

310

Mail to: Alaska Department of Revenue, 550 W 7th Ave STE 500, Anchorage AK 99501-3555

0405-310 Rev 09/06/13- page 1

1

1 2

2 3

3 4

4 5

5 6

6 7

7