Instructions For Credit And Certificate Applications Under As 43.55.023

ADVERTISEMENT

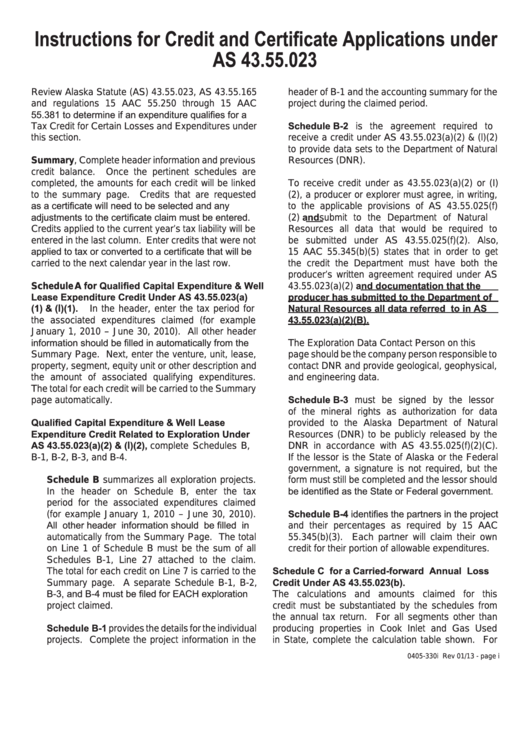

Instructions for Credit and Certificate Applications under

AS 43.55.023

Review Alaska Statute (AS) 43.55.023, AS 43.55.165

header of B-1 and the accounting summary for the

and regulations 15 AAC 55.250 through 15 AAC

project during the claimed period.

55.381 to determine if an expenditure qualifies for a

Schedule B-2 is the agreement required to

Tax Credit for Certain Losses and Expenditures under

this section.

receive a credit under AS 43.55.023(a)(2) & (l)(2)

to provide data sets to the Department of Natural

Summary, Complete header information and previous

Resources (DNR).

credit balance.

Once the pertinent schedules are

completed, the amounts for each credit will be linked

To receive credit under as 43.55.023(a)(2) or (I)

to the summary page. Credits that are requested

(2), a producer or explorer must agree, in writing,

as a certificate will need to be selected and any

to the applicable provisions of AS 43.55.025(f)

adjustments to the certificate claim must be entered.

(2) and submit to the Department of Natural

Credits applied to the current year’s tax liability will be

Resources all data that would be required to

entered in the last column. Enter credits that were not

be submitted under AS 43.55.025(f)(2). Also,

applied to tax or converted to a certificate that will be

15 AAC 55.345(b)(5) states that in order to get

carried to the next calendar year in the last row.

the credit the Department must have both the

producer’s written agreement required under AS

Schedule A for Qualified Capital Expenditure & Well

43.55.023(a)(2) and documentation that the

Lease Expenditure Credit Under AS 43.55.023(a)

producer has submitted to the Department of

(1) & (l)(1).

Natural Resources all data referred to in AS

In the header, enter the tax period for

43.55.023(a)(2)(B).

the associated expenditures claimed (for example

January 1, 2010 – June 30, 2010). All other header

information should be filled in automatically from the

The Exploration Data Contact Person on this

Summary Page. Next, enter the venture, unit, lease,

page should be the company person responsible to

property, segment, equity unit or other description and

contact DNR and provide geological, geophysical,

the amount of associated qualifying expenditures.

and engineering data.

The total for each credit will be carried to the Summary

Schedule B-3 must be signed by the lessor

page automatically.

of the mineral rights as authorization for data

Qualified Capital Expenditure & Well Lease

provided to the Alaska Department of Natural

Expenditure Credit Related to Exploration Under

Resources (DNR) to be publicly released by the

AS 43.55.023(a)(2) & (l)(2), complete Schedules B,

DNR in accordance with AS 43.55.025(f)(2)(C).

B-1, B-2, B-3, and B-4.

If the lessor is the State of Alaska or the Federal

government, a signature is not required, but the

Schedule B summarizes all exploration projects.

form must still be completed and the lessor should

be identified as the State or Federal government.

In the header on Schedule B, enter the tax

period for the associated expenditures claimed

Schedule B-4 identifies the partners in the project

(for example January 1, 2010 – June 30, 2010).

All other header information should be filled in

and their percentages as required by 15 AAC

automatically from the Summary Page. The total

55.345(b)(3). Each partner will claim their own

on Line 1 of Schedule B must be the sum of all

credit for their portion of allowable expenditures.

Schedules B-1, Line 27 attached to the claim.

Schedule C for a Carried-forward Annual Loss

The total for each credit on Line 7 is carried to the

Credit Under AS 43.55.023(b).

Summary page. A separate Schedule B-1, B-2,

B-3, and B-4 must be filed for EACH exploration

The calculations and amounts claimed for this

project claimed.

credit must be substantiated by the schedules from

the annual tax return. For all segments other than

Schedule B-1 provides the details for the individual

producing properties in Cook Inlet and Gas Used

projects. Complete the project information in the

in State, complete the calculation table shown. For

0405-330i Rev 01/13 - page i

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2