result in disapproval of your loan application. This is notice to you as required by the Right to Financial Privacy Act of 1978 that VA or HUD/FHA has a right of accessto fi nancial records held by

fi nancial institutions in connection with the consideration or administration of assistance to you. Financial records involving yourtransaction will be available to VA and HUD/FHA without further

fi nancial institutions in connection with the consideration or administration of assistance to you. Financial records involving yourtransaction will be available to VA and HUD/FHA without further

notice or authorization but will not be disclosed or released by this institution to another GovernmentAgency or Department without your consent except as required or permitted by law.Caution.

Delinquencies, defaults, foreclosures and abuses of mortgage loans involving programs of the Federal Government can be costly and detrimental to yourcredit, now and in the future. The lender in

this transaction, its agents and assigns as well as the Federal Government, its agencies, agents and assigns, areauthorized to take any and all of the following actions in the event loan payments

become delinquent on the mortgage loan described in the attached application: (1)Report your name and account information to a credit bureau; (2) Assess additional interest and penalty charges

for the period of time that payment is not made; (3)Assess charges to cover additional administrative costs incurred by the Government to service your account; (4) Offset amounts owed to you

under other Federalprograms; (5) Refer your account to a private attorney, collection agency or mortgage servicing agency to collect the amount due, foreclose the mortgage, sell theproperty and

seek judgment against you for any defi ciency; (6) Refer your account to the Department of Justice for litigation in the courts; (7) If you are a current orretired Federal employee, take action to offset

your salary, or civil service retirement benefi ts; (8) Refer your debt to the Internal Revenue Service for offset againstany amount owed to you as an income tax refund; and (9) Report any resulting

written-off debt of yours to the Internal Revenue Service as your taxable income. Allof these actions can and will be used to recover any debts owed when it is determined to be in the interest of the

lender and/or the Federal Government to do so.

of these actions can and will be used to recover any debts owed when it is determined to be in the interest of the lender and/o

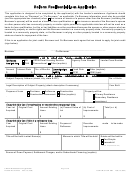

Part IV - Borrower Consent for Social Security Administration to Verify Social Security Number

I authorize the Social Security Administration to verify my Social Security number to the Lender identified in this document and HUD/FHA, through a computer

match conducted by HUD/FHA.

I understand that my consent allows no additional information from my Social Security records to be provided to the Lender, and HUD/FHA and that verification of

my Social Security number does not constitute confirmation of my identity. I also understand that my Social Security number may not be used for any other

purpose than the one stated above, including resale or redisclosure to other parties. The only other redisclosure permitted by this authorization is for review

purposes to ensure that HUD/FHA complies with SSA's consent requirements.

I am the individual to whom the Social Security number was issued or that person's legal guardian. I declare and affirm under the penalty of perjury that the

information contained herein is true and correct. I know that if I make any representation that I know is false to obtain information from Social Security records, I

could be punished by a fine or imprisonment or both.

This consent is valid for 180 days from the date signed, unless indicated otherwise by the individual(s) named in this loan application.

Signature(s) of Borrower(s) - Read consent carefully. Review accuracy of social security number(s) and birth dates provided on

Read consent carefully. Review accuracy of social security number(s) and birth dates provided on this application.

Signature(s) of Borrower(s)

Date Signed

Signature(s) of Co - Borrower(s)

Date Signed

Date signed

Part V - Borrower Certification

. Complete the following for a HUD/FHA Mortgage .

Is it to be sold?

Sales Price

Original Mortgage Amt

22

22

22b.

22

22c.

Do you own or have you sold other real estate within the

Yes

No

Yes

No $

No $

$

$

22a.

past 60 months on which there was a HUD/FHA mortgage?

Address

22d.

If the dwelling to be covered by this mortgage is to be rented, is it a part of, adjacent or contiguous to any project subdivision or group of concentrated

22e.

rental properties involving eight or more dwelling units in which you have any financial interest?

Yes

No

If “Yes” give details.

Do you own more than four dwellings ?

Yes

No If “Yes” submit form HUD-92561.

22f.

Complete for VA-Guaranteed Mortgage . Have you ever had a VA home Loan?

Yes

No

23.

Applicable for Both VA & HUD. As a home loan borrower, you will be legally obligated to make the mortgage payments called for by your mortgage loan contract.

24.

The fact that you dispose of your property after the loan has been made will not relieve you of liability for making these payments. Payment of the loan in full

is ordinarily the way liability on a mortgage note is ended. Some home buyers have the mistaken impression that if they sell their homes when they move to another

locality, or dispose of it for any other reasons, they are no longer liable for the mortgage payments and that liability for these payments is solely that of the new owners.

Even though the new owners may agree in writing to assume liability for your mortgage payments, this assumption agreement will not relieve you from liability to the

holder of the note which you signed when you obtained the loan to buy the property. Unless you are able to sell the property to a buyer who is acceptable to VA or

to HUD/FHA and who will assume the payment of your obligation to the lender, you will not be relieved from liability to repay any claim which VA or HUD/FHA may be

required to pay your lender on account of default in your loan payments. The amount of any such claim payment will be a debt owed by you to the Federal

Government. This debt will be the object of established collection procedures.

25. I, the Undersigned Borrower(s) Certify that:

(b) I was not aware of this valuation when I signed my contract but have elected

to complete the transaction at the contract purchase price or cost. I have paid

(1) I have read and understand the foregoing concerning my liability on the loan and Part

I have read and understand the foregoing concerning my liability on the loan and Part

I have read and understand the foregoing concerning my liability on the loan and Part

or will pay in cash from my own resources at or prior to loan closing a sum equal

III Notices to Borrowers.

III Notices to Borrowers.

to the difference between contract purchase price or cost and the VA or HUD/

(2) Occupancy: ( for VA only -- mark the applicable box)

FHA established value. I do not and will not have outstanding after loan closing

(a) I now actually occupy the above-described property as my home or intend to

(a)

(a) I now actually occupy the above-described property as my home or intend to

I now actually occupy the above-described property as my home or intend to

any unpaid contractual obligation on account of such cash payment.

move into and occupy said property as my home within a reasonable period of time

move into and occupy said property as my home within a reasonable period of time

move into and occupy said property as my home within a reasonable period of time

move into and occupy said property as my home within a reasonable period of time

move into and occupy said property as my home within a reasonable period of time

or intend to reoccupy it after the completion of major alterations, repairs or improve-

or intend to reoccupy it after the completion of major alterations, repairs or improve-

or intend to reoccupy it after the completion of major alterations, repairs or improve-

or intend to reoccupy it after the completion of major alterations, repairs or improve-

(4) Neither I, nor anyone authorized to act for me, will refuse to sell or rent, after

ments.

ments.

the making of a bona fide offer, or refuse to negotiate for the sale or rental of,

(b) My spouse is on active military duty and in his or her absence, I occupy or intend

(b)

(b) My spouse is on active military duty and in his or her absence, I occupy or intend

My spouse is on active military duty and in his or her absence, I occupy or intend

or otherwise make unavailable or deny the dwelling or property covered by his/

to occupy the property securing this loan as my home.

to occupy the property securing this loan as my home.

to occupy the property securing this loan as my home.

her loan to any person because of race, color, religion, sex, handicap, familial status

(c) I previously occupied the property securing this loan as my home. (for interest

(c)

(c) I previously occupied the property securing this loan as my home. (for interest

I previously occupied the property securing this loan as my home. (for interest

or national origin. I recognize that any restrictive covenant on this property relating

rate reductions)

rate reductions)

rate reductions)

to race, color, religion, sex, handicap, familial status or national origin is illegal and

(d) While my spouse was on active military duty and unable to occupy the property

(d)

(d) While my spouse was on active military duty and unable to occupy the property

While my spouse was on active military duty and unable to occupy the property

void and civil action for preventive relief may be brought by the Attorney General

securing this loan, I previously occupied the property that is securing this loan as my

securing this loan, I previously occupied the property that is securing this loan as my

securing this loan, I previously occupied the property that is securing this loan as my

securing this loan, I previously occupied the property that is securing this loan as my

securing this loan, I previously occupied the property that is securing this loan as my

of the United States in any appropriate U.S. District Court against any person re-

home. (for interest rate reduction loans)

home. (for interest rate reduction loans)

sponsible for the violation of the applicable law.

Note: If box 2b or 2d is checked, the veteran's spouse must also sign below.

(5) All information in this application is given for the purpose of obtaining a loan to

(3) Mark the applicable box (not applicable for Home Improvement or Refinancing Loan)

Mark the applicable box (not applicable for Home Improvement or Refinancing Loan)

Mark the applicable box (not applicable for Home Improvement or Refinancing Loan)

be insured under the National Housing Act or guaranteed by the Department of Veterans

I have been informed that ($

I have been informed that ($

) is :

) is :

Affairs and the information in the Uniform Residential Loan Application and this Adden-

the reasonable value of the property as determined by VA or;

dum is true and complete to the best of my knowledge and belief. Verification may be

the statement of appraised value as determined by HUD / FHA.

obtained from any source named herein.

Note: If the contract price or cost exceeds the VA "Reasonable Value" or HUD/FHA

If the contract price or cost exceeds the VA "Reasonable Value" or HUD/FHA

If the contract price or cost exceeds the VA "Reasonable Value" or HUD/FHA

(6) For HUD Only (for properties constructed prior to 1978 ) I have received information

"Statement of Appraised Value", mark either item (a) or item (b), whichever is appli-

"Statement of Appraised Value", mark either item (a) or item (b), whichever is appli-

"Statement of Appraised Value", mark either item (a) or item (b), whichever is appli-

"Statement of Appraised Value", mark either item (a) or item (b), whichever is appli-

cable.

cable.

on lead paint poisoning.

Yes

Not Applicable

(a) I was aware of this valuation when I signed my contract and I have paid or will

(a)

(a) I was aware of this valuation when I signed my contract and I have paid or will

I was aware of this valuation when I signed my contract and I have paid or will

(7) I am aware that neither HUD / FHA nor VA warrants the condition or value of

pay in cash from my own resources at or prior to loan closing a sum equal to the

pay in cash from my own resources at or prior to loan closing a sum equal to the

pay in cash from my own resources at or prior to loan closing a sum equal to the

pay in cash from my own resources at or prior to loan closing a sum equal to the

pay in cash from my own resources at or prior to loan closing a sum equal to the

the property

difference between the contract purchase price or cost and the VA or HUD/FHA

difference between the contract purchase price or cost and the VA or HUD/FHA

difference between the contract purchase price or cost and the VA or HUD/FHA

difference between the contract purchase price or cost and the VA or HUD/FHA

established value. I do not and will not have outstanding after loan closing any unpaid

established value. I do not and will not have outstanding after loan closing any unpaid

established value. I do not and will not have outstanding after loan closing any unpaid

established value. I do not and will not have outstanding after loan closing any unpaid

contractual obligation on account of such cash payment;

contractual obligation on account of such cash payment;

Signature(s) of Borrower(s) -- Do not sign unless this application is fully completed. Read the certifications carefully & review accuracy of this application. Date

Date Signed

Signature(s) of Borrower(s)

Date Signed

Signature(s) of Co - Borrower(s)

( Borrowers Must Sign Both Parts IV & V

( Borrowers Must Sign Both Parts IV & V ) Federal statutes provide severe penalties for any fraud, intentional misrepresentation, or criminal connivance or conspiracy purposed to infl uence

page 2

theissuance of any guaranty or insurance by the VA Secretary or the HUD/FHA Commissioner.

issuance of any guaranty or insurance by the VA Secretary or the HUD/FHA Commissioner.

issuance of any guaranty or insurance by the VA Secretary or the HUD/FHA Commissioner.

(09/2010)

form HUD-92900-A (06/2005)

page 2

VA Form 26-1802a (3/98)

1

1 2

2 3

3 4

4