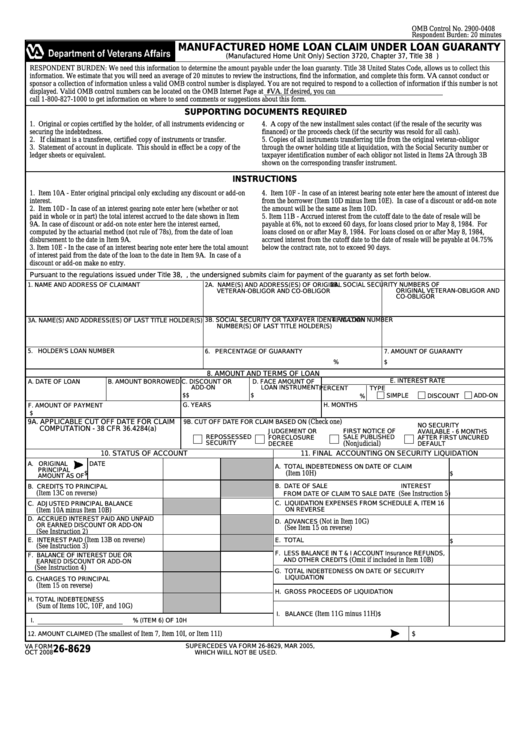

OMB Control No. 2900-0408

Respondent Burden: 20 minutes

MANUFACTURED HOME LOAN CLAIM UNDER LOAN GUARANTY

(Manufactured Home Unit Only) Section 3720, Chapter 37, Title 38 U.S.C.)

RESPONDENT BURDEN: We need this information to determine the amount payable under the loan guaranty. Title 38 United States Code, allows us to collect this

information. We estimate that you will need an average of 20 minutes to review the instructions, find the information, and complete this form. VA cannot conduct or

sponsor a collection of information unless a valid OMB control number is displayed. You are not required to respond to a collection of information if this number is not

displayed. Valid OMB control numbers can be located on the OMB Internet Page at If desired, you can

call 1-800-827-1000 to get information on where to send comments or suggestions about this form.

SUPPORTING DOCUMENTS REQUIRED

1. Original or copies certified by the holder, of all instruments evidencing or

4. A copy of the new installment sales contact (if the resale of the security was

securing the indebtedness.

financed) or the proceeds check (if the security was resold for all cash).

5. Copies of all instruments transferring title from the original veteran-obligor

2. If claimant is a transferee, certified copy of instruments or transfer.

3. Statement of account in duplicate. This should in effect be a copy of the

through the owner holding title at liquidation, with the Social Security number or

ledger sheets or equivalent.

taxpayer identification number of each obligor not listed in Items 2A through 3B

shown on the corresponding transfer instrument.

INSTRUCTIONS

1. Item 10A - Enter original principal only excluding any discount or add-on

4. Item 10F - In case of an interest bearing note enter here the amount of interest due

interest.

from the borrower (Item 10D minus Item 10E). In case of a discount or add-on note

2. Item 10D - In case of an interest gearing note enter here (whether or not

the amount will be the same as Item 10D.

paid in whole or in part) the total interest accrued to the date shown in Item

5. Item 11B - Accrued interest from the cutoff date to the date of resale will be

9A. In case of discount or add-on note enter here the interest earned,

payable at 6%, not to exceed 60 days, for loans closed prior to May 8, 1984. For

computed by the actuarial method (not rule of 78s), from the date of loan

loans closed on or after May 8, 1984. For loans closed on or after May 8, 1984,

disbursement to the date in Item 9A.

accrued interest from the cutoff date to the date of resale will be payable at 04.75%

3. Item 10E - In the case of an interest bearing note enter here the total amount

below the contract rate, not to exceed 90 days.

of interest paid from the date of the loan to the date in Item 9A. In case of a

discount or add-on make no entry.

Pursuant to the regulations issued under Title 38, U.S.C., the undersigned submits claim for payment of the guaranty as set forth below.

2B. SOCIAL SECURITY NUMBERS OF

1. NAME AND ADDRESS OF CLAIMANT

2A. NAME(S) AND ADDRESS(ES) OF ORIGINAL

ORIGINAL VETERAN-OBLIGOR AND

VETERAN-OBLIGOR AND CO-OBLIGOR

CO-OBLIGOR

4. VA LOAN NUMBER

3B. SOCIAL SECURITY OR TAXPAYER IDENTIFICATION

3A. NAME(S) AND ADDRESS(ES) OF LAST TITLE HOLDER(S)

NUMBER(S) OF LAST TITLE HOLDER(S)

5. HOLDER'S LOAN NUMBER

6. PERCENTAGE OF GUARANTY

7. AMOUNT OF GUARANTY

%

$

8. AMOUNT AND TERMS OF LOAN

E. INTEREST RATE

A. DATE OF LOAN

B. AMOUNT BORROWED C. DISCOUNT OR

D. FACE AMOUNT OF

ADD-ON

LOAN INSTRUMENT

PERCENT

TYPE

$

$

$

SIMPLE

ADD-ON

%

DISCOUNT

H. MONTHS

F. AMOUNT OF PAYMENT

G. YEARS

$

9A. APPLICABLE CUT OFF DATE FOR CLAIM

(Check one)

9B. CUT OFF DATE FOR CLAIM BASED ON

NO SECURITY

COMPUTATION - 38 CFR 36.4284(a)

FIRST NOTICE OF

JUDGEMENT OR

AVAILABLE - 6 MONTHS

REPOSSESSED

SALE PUBLISHED

FORECLOSURE

AFTER FIRST UNCURED

SECURITY

(Nonjudicial)

DECREE

DEFAULT

10. STATUS OF ACCOUNT

11. FINAL ACCOUNTING ON SECURITY LIQUIDATION

DATE

A. ORIGINAL

A. TOTAL INDEBTEDNESS ON DATE OF CLAIM

PRINCIPAL

(Item 10H)

$

$

AMOUNT AS OF

B. DATE OF SALE

INTEREST

B. CREDITS TO PRINCIPAL

(Item 13C on reverse)

(See Instruction 5)

FROM DATE OF CLAIM TO SALE DATE

C. ADJUSTED PRINCIPAL BALANCE

C. LIQUIDATION EXPENSES FROM SCHEDULE A, ITEM 16

ON REVERSE

(Item 10A minus Item 10B)

D. ACCRUED INTEREST PAID AND UNPAID

(Not in Item 10G)

D. ADVANCES

OR EARNED DISCOUNT OR ADD-ON

(See Item 15 on reverse)

(See Instruction 2)

E. INTEREST PAID

(Item 13B on reverse)

E. TOTAL

$

(See Instruction 3)

F. LESS BALANCE IN T & I ACCOUNT Insurance REFUNDS,

F. BALANCE OF INTEREST DUE OR

AND OTHER CREDITS

(Omit if included in Item 10B)

EARNED DISCOUNT OR ADD-ON

(See Instruction 4)

G. TOTAL INDEBTEDNESS ON DATE OF SECURITY

LIQUIDATION

G. CHARGES TO PRINCIPAL

(Item 15 on reverse)

H. GROSS PROCEEDS OF LIQUIDATION

H. TOTAL INDEBTEDNESS

(Sum of Items 10C, 10F, and 10G)

(Item 11G minus 11H)

I. BALANCE

$

I.

% (ITEM 6) OF 10H

$

12. AMOUNT CLAIMED

(The smallest of Item 7, Item 10I, or Item 11I)

SUPERCEDES VA FORM 26-8629, MAR 2005,

VA FORM

26-8629

OCT 2008

WHICH WiILL NOT BE USED.

1

1 2

2