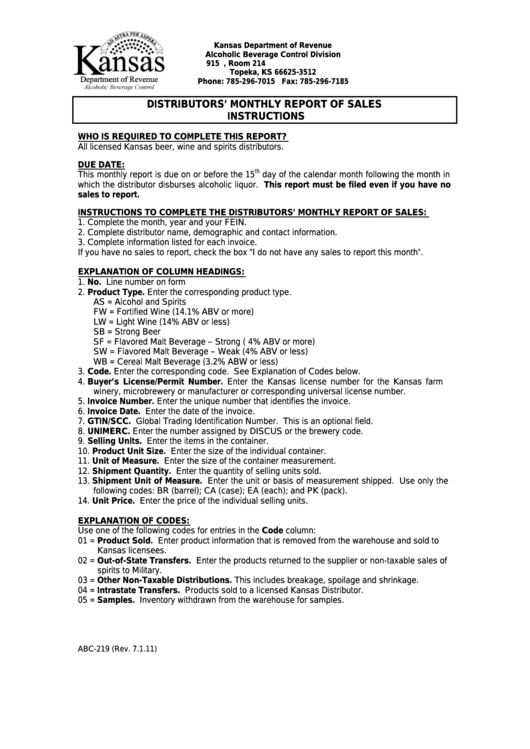

Kansas Department of Revenue

Alcoholic Beverage Control Division

915 S.W. Harrison Street, Room 214

Topeka, KS 66625-3512

Phone: 785-296-7015 Fax: 785-296-7185

DISTRIBUTORS’ MONTHLY REPORT OF SALES

INSTRUCTIONS

WHO IS REQUIRED TO COMPLETE THIS REPORT?

All licensed Kansas beer, wine and spirits distributors.

DUE DATE:

th

This monthly report is due on or before the 15

day of the calendar month following the month in

which the distributor disburses alcoholic liquor. This report must be filed even if you have no

sales to report.

INSTRUCTIONS TO COMPLETE THE DISTRIBUTORS’ MONTHLY REPORT OF SALES:

1. Complete the month, year and your FEIN.

2. Complete distributor name, demographic and contact information.

3. Complete information listed for each invoice.

If you have no sales to report, check the box “I do not have any sales to report this month”.

EXPLANATION OF COLUMN HEADINGS:

1. No. Line number on form

2. Product Type. Enter the corresponding product type.

AS = Alcohol and Spirits

FW = Fortified Wine (14.1% ABV or more)

LW = Light Wine (14% ABV or less)

SB = Strong Beer

SF = Flavored Malt Beverage – Strong ( 4% ABV or more)

SW = Flavored Malt Beverage – Weak (4% ABV or less)

WB = Cereal Malt Beverage (3.2% ABW or less)

3. Code. Enter the corresponding code. See Explanation of Codes below.

4. Buyer’s License/Permit Number. Enter the Kansas license number for the Kansas farm

winery, microbrewery or manufacturer or corresponding universal license number.

5. Invoice Number. Enter the unique number that identifies the invoice.

6. Invoice Date. Enter the date of the invoice.

7. GTIN/SCC. Global Trading Identification Number. This is an optional field.

8. UNIMERC. Enter the number assigned by DISCUS or the brewery code.

9. Selling Units. Enter the items in the container.

10. Product Unit Size. Enter the size of the individual container.

11. Unit of Measure. Enter the size of the container measurement.

12. Shipment Quantity. Enter the quantity of selling units sold.

13. Shipment Unit of Measure. Enter the unit or basis of measurement shipped. Use only the

following codes: BR (barrel); CA (case); EA (each); and PK (pack).

14. Unit Price. Enter the price of the individual selling units.

EXPLANATION OF CODES:

Use one of the following codes for entries in the Code column:

01 = Product Sold. Enter product information that is removed from the warehouse and sold to

Kansas licensees.

02 = Out-of-State Transfers. Enter the products returned to the supplier or non-taxable sales of

spirits to Military.

03 = Other Non-Taxable Distributions. This includes breakage, spoilage and shrinkage.

04 = Intrastate Transfers. Products sold to a licensed Kansas Distributor.

05 = Samples. Inventory withdrawn from the warehouse for samples.

ABC-219 (Rev. 7.1.11)

1

1 2

2 3

3