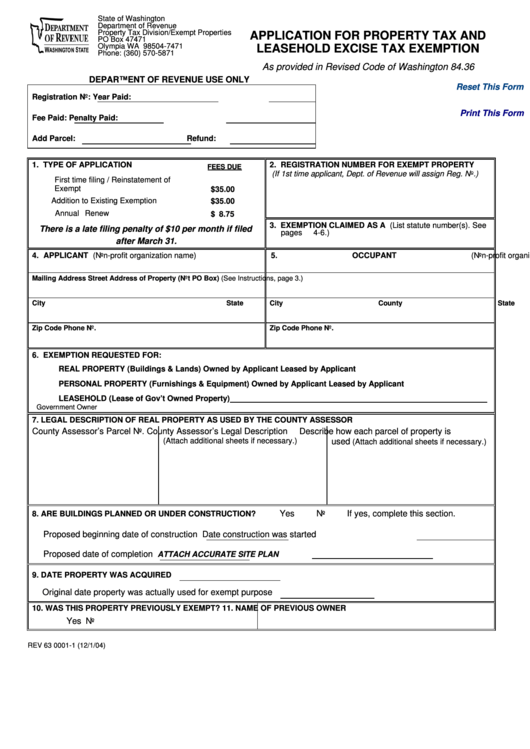

State of Washington

Department of Revenue

Property Tax Division/Exempt Properties

APPLICATION FOR PROPERTY TAX AND

PO Box 47471

Olympia WA 98504-7471

LEASEHOLD EXCISE TAX EXEMPTION

Phone: (360) 570-5871

As provided in Revised Code of Washington 84.36

DEPARTMENT OF REVENUE USE ONLY

Reset This Form

Registration No:

Year Paid:

Print This Form

Fee Paid:

Penalty Paid:

Add Parcel:

Refund:

1. TYPE OF APPLICATION

2. REGISTRATION NUMBER FOR EXEMPT PROPERTY

FEES DUE

(If 1st time applicant, Dept. of Revenue will assign Reg. No.)

First time filing / Reinstatement of

Exemption...................................................

$35.00

Addition to Existing Exemption ...................

$35.00

Annual Renewal..........................................

$ 8.75

3. EXEMPTION CLAIMED AS A (List statute number(s). See

There is a late filing penalty of $10 per month if filed

pages 4-6.)

after March 31.

4. APPLICANT (Non-profit organization name)

5. OCCUPANT (Non-profit organization name)

Mailing Address

Street Address of Property (Not PO Box) (See Instructions, page 3.)

City

State

City

County

State

Zip Code

Phone No.

Zip Code

Phone No.

6. EXEMPTION REQUESTED FOR:

REAL PROPERTY (Buildings & Lands)....................................

Owned by Applicant

Leased by Applicant

PERSONAL PROPERTY (Furnishings & Equipment) .............

Owned by Applicant

Leased by Applicant

LEASEHOLD (Lease of Gov’t Owned Property)

Government Owner

7. LEGAL DESCRIPTION OF REAL PROPERTY AS USED BY THE COUNTY ASSESSOR

County Assessor’s Parcel No.

County Assessor’s Legal Description

Describe how each parcel of property is

(Attach additional sheets if necessary.)

used

(Attach additional sheets if necessary.)

Yes

No

If yes, complete this section.

8. ARE BUILDINGS PLANNED OR UNDER CONSTRUCTION?

Proposed beginning date of construction

Date construction was started

Proposed date of completion

ATTACH ACCURATE SITE PLAN

9. DATE PROPERTY WAS ACQUIRED

Original date property was actually used for exempt purpose

10. WAS THIS PROPERTY PREVIOUSLY EXEMPT?

11. NAME OF PREVIOUS OWNER

Yes

No

REV 63 0001-1 (12/1/04)

Next Page

1

1 2

2