ENTER YOUR EIN: ___ ___ __ ___ ___ ___ ___ ___ ___

OR

SSN: ___ ___ ___ __ ___ __ ___ ___ ___

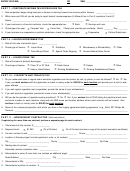

PART 7

– CORPORATE INCOME TAX OR PRIVILEGE TAX

1. Date corporation began doing business in Kansas or deriving income from sources within Kansas: _____ _____ _____

2. What name and EIN will you be using to report federal income/expenses (if different than in Part 3, questions 2 and 6)?

Name: _______________________________________________________________

EIN: ___ ___ ___ ___ ___ ___ ___ ___ ___

ˆ

ˆ

3. If your business is a financial institution, check the appropriate box:

Bank

Savings and Loan

ˆ

ˆ

4. Check type of tax year:

Calendar Year

Fiscal Year

If fiscal year, provide year-end date: Month ________ Day ________

ˆ

ˆ

5. If your business is a cooperative or political subdivision, check the appropriate box:

Cooperative

Political Subdivision

PART 8

– LIQUOR ENFORCEMENT TAX

1. Date of first sale of alcoholic liquor: _____ _____ _____

ˆ

ˆ

ˆ

ˆ

2. Check type of license:

Liquor Store

Distributor

Microbrewery or Microdistillery

Other

ˆ

ˆ

ˆ

Farm Winery/Outlet

Special Order Shipping

Farmers Market Sales Permit

PART 9

– LIQUOR DRINK TAX

1. Date of first sale of alcoholic beverages:

_____ _____ _____

ˆ

ˆ

ˆ

ˆ

2. Check type of license:

Class “A” or “B” Club

Public Venue

Caterer

Other

ˆ

ˆ

ˆ

Hotel or Hotel/Caterer

Drinking Establishment

Drinking Establishment/Caterer

PART 10

– CIGARETTE AND TOBACCO TAX

ˆ

ˆ

1. Do you make retail sales of regular and/or electronic cigarettes over-the-counter, by mail, by phone, or over the internet?

No

Yes

If yes, you must enclose with this application a check or money order for $25.00 for each location and provide your e-mail or web

page address: ________________________________________________________________________________________________

2. If you sell regular cigarettes (not e-cigarettes), provide the name of your wholesaler(s): _____________________________________

3. If you sell electronic cigarettes, provide the name of your wholesaler(s): __________________________________________________

ˆ

ˆ

4. Will you be the operator of cigarette vending machines?

No

Yes If yes, enclose Form CG-83 listing the machine brand name

and serial number for each machine, along with the DBA name and location address where each machine will be located. Also

enclose a check or money order for $25.00 for each machine.

5. Name of the company/corporation with whom you have a fuel supply agreement/retailing agreement (e.g., Shell, BP, Phillips 66,

Conoco): ____________________________________________________________________________________________________

PART 11

– NONRESIDENT CONTRACTOR

(See instructions)

If registering for more than one contract, enclose a separate page for each contract.

1. Total amount of this contract: $ ______________

ˆ

ˆ

ˆ

2. Required bond:

$1,000

8% of Contract

4% of Contract (enclose a copy of the project exemption certificate)

3. List who contract is with: ___________________________________________

Phone: ___ ___ ___ ___ ___ ___ ___ ___ ___ ___

4. Location of Kansas project (include apartment, suite, or lot number): ____________________________________________________

City ____________________________________ County __________________ State ___________ Zip Code ________________

5. Starting date of contract: _____ _____ _____

Estimated contract completion date: _____ _____ _____

6. Subcontractor’s name (If more than one, enclose an additional page): ____________________________________________________

Street Address ____________________________ City _______________________ State _________ Zip Code _______________

7. Subcontractor’s EIN:

___ ___ __ ___ ___ ___ ___ ___ ___

8. Subcontractor’s portion of contract: $ _______________________________

11

1

1 2

2 3

3 4

4