PAGE 2

INSTRUCTIONS

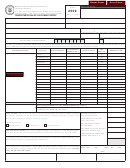

IMPORTANT: This report must be filed in lieu of the Missouri Sales Tax Return to report all nonprotested amounts of taxes in a

period for which you filed a protest payment affidavit. Report only nonprotested payments on this report. Protest payments must

be reported on the Sales Tax Protest Payment Affidavit (DOR-163).

BUSINESS IDENTIFICATION: Enter Missouri Integrated Tax System (MITS) Account Number, reporting period, owner’s name, business

name and mailing address on the spaces provided at the top of this report.

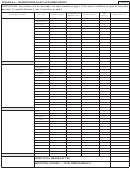

BUSINESS LOCATION: Enter the address of each business location for which you have the responsibility of reporting tax.

TAX TYPE: Listed in this column are the sales taxes administered by the Department of Revenue. It is your responsibility to know which

taxes you are liable for at each business location. Enter each city and/or county tax type which is not being protested.

GROSS RECEIPTS: Enter all nonprotested gross receipts by each specific tax type for each business location.

ADJUSTMENTS: Enter authorized adjustments. Be sure to indicate plus or minus for each adjustment.

TAXABLE SALES: Complete taxable sales for each entry.

GROSS RECEIPTS (+) or (–) ADJUSTMENTS = TAXABLE SALES

TAX RATE: The state, conservation, education and parks/soil sales tax rates are preprinted in this column. If you are subject to city and/or

county taxes, enter the local sales tax rate for each city and/or county tax type.

AMOUNT OF TAX: Multiply taxable sales by the tax rate of each specific tax.

TOTAL FROM SCHEDULE A: Enter total amount of tax from Schedule A.

LINE 1 — TOTAL AMOUNT OF TAX: Compute total amount of taxes shown in the amount of tax column.

LINE 2 — TIMELY PAYMENT ALLOWANCE: If you file and pay on or before the due date, enter 2% of the amount shown on Line 1.

LINE 3 — Follow instructions shown on front of form.

LINE 4 — INTEREST FOR LATE PAYMENT: If tax is not paid by the due date, multiply Line 3 by the annual percentage rate and then

multiply this amount by the number of days late divided by 365 (or 366 in a leap year). The annual percentage rate is subject to change

each year. The annual percentage rate can be obtained from our web site at:

LINES 5 and 6 — Follow instructions shown on front of form.

MO 860-1521 (11-2007)

DOR-2039 (11-2007)

1

1 2

2 3

3