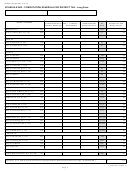

BOE-531-AE2 (S2) REV. 15 (7-13)

SCHEDULE AE2 - COMPUTATION SCHEDULE FOR DISTRICT TAX - Long Form

ACCOUNT NUMBER

REPORTING PERIOD

A5

A6/A7

A8

A9

A10

DISTRICT TAX AREAS

ALLOCATE LINE A4 TO

ADD ( + ) / DEDUCT ( - )

TAXABLE AMOUNT

TAX

DISTRICT TAX DUE

CORRECT DISTRICT(S)

ADJUSTMENTS

A5 plus/minus A6/A7

RATE

Multiply A8 by A9

$

.00

IMPERIAL CO.

029

.005

City of Calexico (Eff. 10-1-10)

.00

230

.01

.005

.00

INYO CO.

014

KERN CO.

City of Arvin (Eff. 4-1-09)

.00

198

.01

City of Delano (Eff. 4-1-08)

.00

170

.01

City of Ridgecrest (Eff. 10-1-12)

.00

291

.0075

LAKE CO.

City of Clearlake

.00

058

.005

City of Lakeport

.00

101

.005

.00

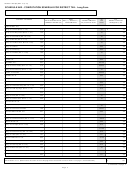

LOS ANGELES CO. (Eff. 7-1-09)

218

.015

City of Avalon (Eff. 7-1-09)

.00

219

.02

City of Commerce (Eff. 4-1-13)

.00

307

.02

City of Culver City (Eff. 4-1-13)

.00

.02

305

City of El Monte

.00

222

.02

City of Inglewood (Eff. 7-1-09)

.00

220

.02

City of La Mirada (Eff. 4-1-13)

.00

309

.025

City of Pico Rivera (Eff. 7-1-09)

.00

223

.025

City of Santa Monica (Eff. 4-1-11)

.00

250

.02

City of South El Monte (Eff. 4-1-11)

252

.02

.00

City of South Gate (Eff. 7-1-09)

.00

221

.025

MADERA CO. (Eff. 4-1-07)

.00

144

.005

MARIN CO. (Eff. 4-1-13)

.00

.01

311

City of Fairfax (Eff. 4-1-13)

.00

.015

314

City of Novato (Eff. 4-1-13)

.00

313

.015

City of San Rafael (Eff. 4-1-13)

312

.015

.00

MARIPOSA CO.

.005

.00

103

MENDOCINO CO. (Eff. 4-1-12)

.00125

.00

269

City of Fort Bragg (Eff. 7-1-12)

.01125

.00

284

City of Point Arena (Eff. 4-1-12)

.00625

.00

271

City of Ukiah (Eff. 4-1-12)

273

.00625

.00

City of Willits (Eff. 4-1-12)

.00

270

.00625

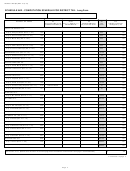

MERCED CO.

.00

City of Atwater (Eff. 7-1-13)

346

.005

City of Gustine (Eff. 4-1-10)

.00

.005

224

City of Los Banos

.00

104

.005

City of Merced

127

.00

.005

MONO CO.

City of Mammoth Lakes (Eff. 10-1-08)

.00

183

.005

SUBTOTAL A11b

$

.00

(Add amounts in column A10 on this page. Enter the total here and on line A11b on page 1 of Schedule AE2.)

Continued on page 3

Page 2

1

1 2

2 3

3 4

4 5

5 6

6