BOE-531-AE2 (S5) REV. 15 (7-13)

INSTRUCTIONS FOR COMPLETING BOE-531, SCHEDULES AE2, D, AND E

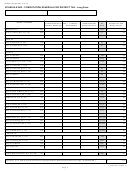

BOE-531-AE2, SCHEDULE AE2

Note: Adjustments to district taxes no longer in effect and not included on Schedule AE2 should be made on a separate sheet and attached to

your return. Computation of the district use tax is to be made on Schedule AE2 and the amount of district tax on line A11 is to be entered on line

10 on the front of the BOE-401-E tax return.

Column A1:

Enter total purchase price of tangible personal property, the storage or other consumption of which is subject to LOCAL USE TAX.

Column A2/A3: DEDUCT - Purchases of tangible personal property on which district use tax does not apply.

Using the total on line A4, list your transactions by the correct district. Do not report the same transactions in both a city and

Column A5:

county district.

The tax rates for city districts include

county district tax.

Report those transactions under the city only.

all

Column A6/A7: ADD the purchase price of goods on which the state, county, and local taxes, but not the district tax, were paid to the vendor, and

a taxable use of the goods was made in the district.

Column A9:

If you enter transactions on line A6/A7 for transactions taxed at a rate different than what is shown in column A9, call

1-800-400-7115 for assistance.

Column A10:

Enter the amount of district tax due. Multiply column A8 by column A9. Enter the result in column A10.

Column A11:

Add lines A11a, A11b, A11c, A11d, and A11e. Enter this amount on line A11 and on line 10 of your Consumer Use Tax Return.

Publication 71,

provides tax rates for cities and counties throughout California. Publication 44,

California City and County Sales and Use Tax Rates

provides additional information about district taxes. These publications are available on our website at

District Taxes

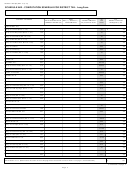

BOE-531-D, SCHEDULE D

This schedule must be completed if all of the following conditions are met:

You purchased property from out-of-state,

You did not pay California State Use Tax on the purchase,

You used the property at locations different than the address on your permit, and

The one percent combined state and local tax on the purchases exceeds $600 a year.

Itemize all purchases from out of state reported on line 1 of the return. List the name and address of each seller you purchased from. Give a

general description of the property purchased. Show the date received in California and the purchase price. Additional schedule pages may be

attached if needed.

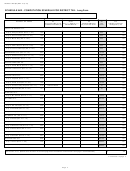

BOE-531-E, SCHEDULE E

If your business activities were conducted in such a manner that part or all of your one percent combined state and local use tax should be

allocated to a county or counties other than the county in which you maintain your address of record, you should complete Schedule E - Detailed

Allocation by County of One Percent Combined State and Uniform Local Use Tax. Examples of persons who are required to complete this schedule

are:

CONSTRUCTION CONTRACTORS (Regulation 1806). A contractor must report the one percent combined state and local use tax with respect to

materials involved in construction contracts according to the county location of the jobsite. Enter this tax in column C opposite the appropriate

county.

PURCHASES FROM OUT-OF-STATE SELLERS WHO HAVE NO REGULAR PLACE OF BUSINESS IN CALIFORNIA (Regulation 1803). If the seller

does not have a stock of goods located in California and delivery is made from an out-of-state point, enter in column C the amount of one percent

combined state and local use tax opposite the county in which the property is first functionally used.*

PERSONS MAKING EX-TAX PURCHASES FOR USE AT LOCATIONS WHERE A SELLER'S PERMIT IS NOT REQUIRED (Regulation 1803). A

person who purchases tangible personal property without payment of the combined state and uniform local use tax is liable for the combined state

and local use tax on such purchases. If the property is used at a location for which a seller's permit is not required, enter in column C, the amount

of one percent combined state and local use tax for the county in which such tangible personal property is first functionally used.

LINE E2. COMBINED STATE AND LOCAL USE TAX AT PERMANENT PLACE OF BUSINESS. Enter here the amount of one percent state and local

use tax on merchandise first functionally used at your permanent place of business in California. Do not include any one percent combined state

and local use tax reported by counties in column C.

PERSONS MAKING EX-TAX PURCHASES OF $500,000 OR MORE. A person who purchases tangible personal property without payment of the

one percent combined state and local use tax is liable for the one percent combined state and local use tax on such purchases. If the purchase

price is $500,000 or more, and the property is first functionally used at a location for which a seller's permit is not required, the one percent

combined state and local use tax should be reported on the BOE-531-F, Schedule F, Detailed Allocation by City of One Percent Uniform Local

Sales and Use Tax.

You can obtain a Schedule F and the publications mentioned above by visiting our website at , or by calling our Taxpayer

Information Section at 1-800-400-7115 (TTY:711). Customer service representatives are available weekdays from 8:00 a.m. to 5:00 p.m. (Pacific

time), except state holidays.

*For sales and use tax purposes, the term functional use means use for the purpose for which the property was designed. For additional

information, please refer to Regulation 1620(b)(3).

Page 6

1

1 2

2 3

3 4

4 5

5 6

6