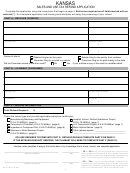

Form Rdgs - Retail Dealer'S Gasoline Shrinkage Refund Application Page 2

ADVERTISEMENT

Instructions for completing the Retail Dealer’s Gasoline Shrinkage Refund Application

Retail dealers are allowed a semi-annual refund to compensate the dealer for losses due to shrinkage or evaporation to a

maximum of ½ of 1% of tax paid gasoline purchases. For purposes of this refund, a retail dealer is a business that sells

gasoline at retail and delivers the fuel directly into the tanks of a motor vehicle or watercraft. A distributor or wholesaler is a

retail dealer only with respect to gasoline delivered into a retail storage tank operated by that distributor or wholesaler or into

a retail storage tank of a consignee or commission agent.

1. Enter the total tax paid gallons purchased from your supplier between the Period Begin and Period End dates pre-printed

at the top of the form. If you have made purchases from more than one supplier, attach a detailed schedule to the form,

showing only the totals on the refund application. Use the following format:

Supplier Name

Type of Fuel Purchased

Gallons Purchased

Tax Rate

Tax Paid

Contact Maine Revenue Services at 207-624-9609 or at fuel.tax@maine.gov if you have questions about the correct tax rate

to use for gasoline blends. Your supplier should also know the appropriate tax rate.

2. An authorized representative for each supplier is required to sign the refund application verifying the number of gallons

purchased and amount of tax paid is correct.

3. An authorized representative for the retail dealer is required to sign the refund application under the pains of perjury.

Maine Revenue Services imposes penalties for intentionally overstating the amount of a refund due.

The due date is pre-printed in the upper right hand area of the refund application.

Late or incomplete returns will not be accepted.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2