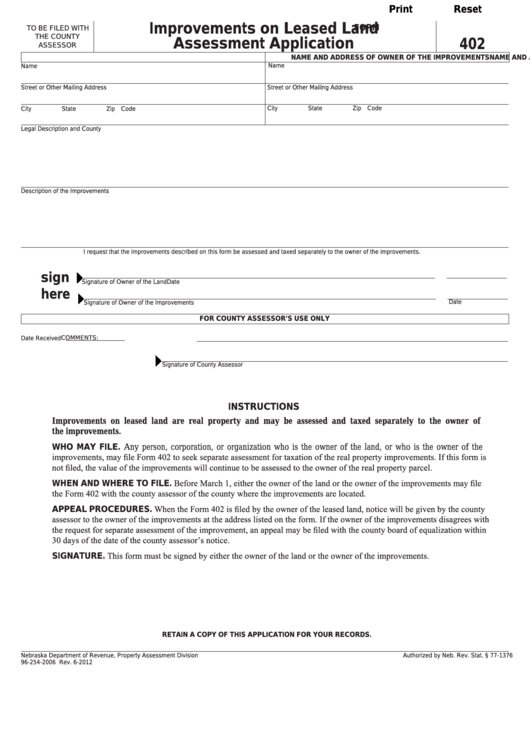

Print

Reset

Improvements on Leased Land

FORM

TO BE FILED WITH

THE COUNTY

Assessment Application

402

ASSESSOR

NAME AND ADDRESS OF OWNER OF THE LAND

NAME AND ADDRESS OF OWNER OF THE IMPROVEMENTS

Name

Name

Street or Other Mailing Address

Street or Other Mailing Address

City

State

Zip Code

City

State

Zip Code

Legal Description and County

Description of the Improvements

I request that the improvements described on this form be assessed and taxed separately to the owner of the improvements.

sign

Signature of Owner of the Land

Date

here

Date

Signature of Owner of the Improvements

FOR COUNTY ASSESSOR’S USE ONLY

COMMENTS:

Date Received

Signature of County Assessor

INSTRUCTIONS

Improvements on leased land are real property and may be assessed and taxed separately to the owner of

the improvements.

WHO MAY FILE. Any person, corporation, or organization who is the owner of the land, or who is the owner of the

improvements, may file Form 402 to seek separate assessment for taxation of the real property improvements. If this form is

not filed, the value of the improvements will continue to be assessed to the owner of the real property parcel.

WHEN AND WHERE TO FILE. Before March 1, either the owner of the land or the owner of the improvements may file

the Form 402 with the county assessor of the county where the improvements are located.

APPEAL PROCEDURES. When the Form 402 is filed by the owner of the leased land, notice will be given by the county

assessor to the owner of the improvements at the address listed on the form. If the owner of the improvements disagrees with

the request for separate assessment of the improvement, an appeal may be filed with the county board of equalization within

30 days of the date of the county assessor’s notice.

SIGNATURE. This form must be signed by either the owner of the land or the owner of the improvements.

RETAIN A COPY OF THIS APPLICATION FOR YOUR RECORDS.

Nebraska Department of Revenue, Property Assessment Division

Authorized by Neb. Rev. Stat. § 77-1376

96-254-2006 Rev. 6-2012

1

1