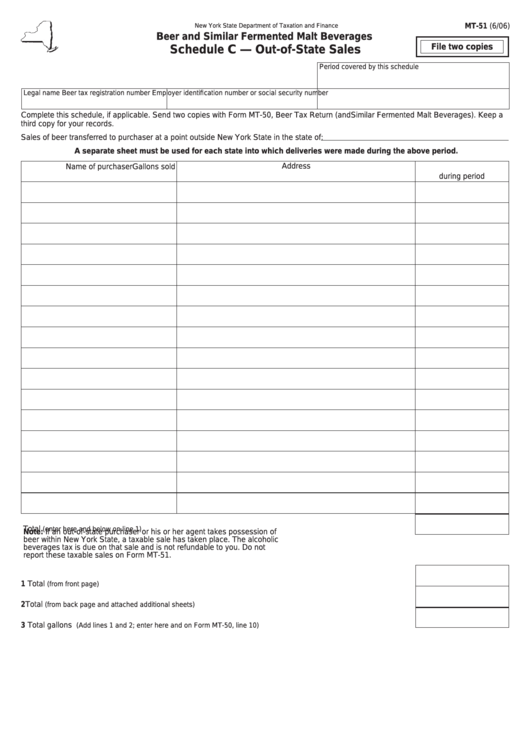

Form Mt-51 - Beer And Similar Fermented Malt Beverages - Schedule C - Out-Of-State Sales

ADVERTISEMENT

MT-51 (6/06)

New York State Department of Taxation and Finance

Beer and Similar Fermented Malt Beverages

File two copies

Schedule C — Out-of-State Sales

Period covered by this schedule

Legal name

Beer tax registration number

Employer identification number or social security number

Complete this schedule, if applicable. Send two copies with Form MT-50, Beer Tax Return (and Similar Fermented Malt Beverages). Keep a

third copy for your records.

Sales of beer transferred to purchaser at a point outside New York State in the state of:

A separate sheet must be used for each state into which deliveries were made during the above period.

Address

Name of purchaser

Gallons sold

during period

Total

(enter here and below on line 1)

Note: If an out-of-state purchaser or his or her agent takes possession of

beer within New York State, a taxable sale has taken place. The alcoholic

beverages tax is due on that sale and is not refundable to you. Do not

report these taxable sales on Form MT-51.

1 Total

(from front page) ................................................................................................................................................................

2 Total

..................................................................................................

(from back page and attached additional sheets)

3 Total gallons

......................................................................

(Add lines 1 and 2; enter here and on Form MT-50, line 10)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2