Form Mt-53 - Schedule E Beer And Similar Fermented Malt Beverages - New York State Department Of Taxation And Finance

ADVERTISEMENT

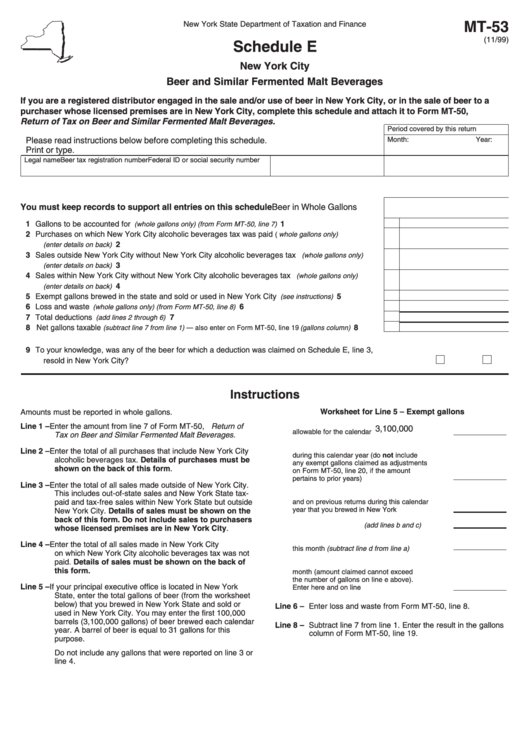

MT-53

New York State Department of Taxation and Finance

(11/99)

Schedule E

New York City

Beer and Similar Fermented Malt Beverages

If you are a registered distributor engaged in the sale and/or use of beer in New York City, or in the sale of beer to a

purchaser whose licensed premises are in New York City, complete this schedule and attach it to Form MT-50,

Return of Tax on Beer and Similar Fermented Malt Beverages.

Period covered by this return

Month:

Year:

Please read instructions below before completing this schedule.

Print or type.

Legal name

Beer tax registration number

Federal ID or social security number

You must keep records to support all entries on this schedule

Beer in Whole Gallons

1 Gallons to be accounted for

..............................................

1

(whole gallons only) (from Form MT-50, line 7)

2 Purchases on which New York City alcoholic beverages tax was paid

( whole gallons only)

..........................................................................................................................

2

(enter details on back)

3 Sales outside New York City without New York City alcoholic beverages tax

(whole gallons only)

..........................................................................................................................

3

(enter details on back)

4 Sales within New York City without New York City alcoholic beverages tax

(whole gallons only)

..........................................................................................................................

4

(enter details on back)

5 Exempt gallons brewed in the state and sold or used in New York City

....................

5

(see instructions)

6 Loss and waste

.................................................................

6

(whole gallons only) (from Form MT-50, line 8)

7 Total deductions

.................................................................................................

7

(add lines 2 through 6)

8 Net gallons taxable

............

8

(subtract line 7 from line 1) — also enter on Form MT-50, line 19 (gallons column)

9 To your knowledge, was any of the beer for which a deduction was claimed on Schedule E, line 3,

resold in New York City? ...........................................................................................................................................

Yes

No

Instructions

Amounts must be reported in whole gallons.

Worksheet for Line 5 – Exempt gallons

a. Total exemption from the New York City tax

Line 1 – Enter the amount from line 7 of Form MT-50, Return of

3,100,000

allowable for the calendar year ............................

Tax on Beer and Similar Fermented Malt Beverages.

b. Exemption claimed on previous returns

Line 2 – Enter the total of all purchases that include New York City

during this calendar year (do not include

alcoholic beverages tax. Details of purchases must be

any exempt gallons claimed as adjustments

shown on the back of this form.

on Form MT-50, line 20, if the amount

pertains to prior years) .........................................

Line 3 – Enter the total of all sales made outside of New York City.

This includes out-of-state sales and New York State tax-

c. Gallons claimed on line 4 on this current return

paid and tax-free sales within New York State but outside

and on previous returns during this calendar

year that you brewed in New York State .............

New York City. Details of sales must be shown on the

back of this form. Do not include sales to purchasers

d. Total exemptions claimed (add lines b and c) .........

whose licensed premises are in New York City.

e. Maximum allowable exemption for

Line 4 – Enter the total of all sales made in New York City

.............

this month (subtract line d from line a)

on which New York City alcoholic beverages tax was not

paid. Details of sales must be shown on the back of

f. Exempt gallons of beer sold or used this

this form.

month (amount claimed cannot exceed

the number of gallons on line e above).

Line 5 – If your principal executive office is located in New York

Enter here and on line 5 .......................................

State, enter the total gallons of beer (from the worksheet

below) that you brewed in New York State and sold or

Line 6 – Enter loss and waste from Form MT-50, line 8.

used in New York City. You may enter the first 100,000

barrels (3,100,000 gallons) of beer brewed each calendar

Line 8 – Subtract line 7 from line 1. Enter the result in the gallons

year. A barrel of beer is equal to 31 gallons for this

column of Form MT-50, line 19.

purpose.

Do not include any gallons that were reported on line 3 or

line 4.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2