Alaska Tire Fees Quarterly Return Instructions Page 2

ADVERTISEMENT

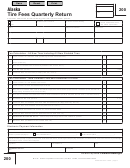

Alaska Tire Fees Quarterly Return Instructions

• Enter the name of a contact person, the title of that person

Schedule A - Tire Inventory

and the telephone number for the individual. This individual

Each seller who collects the tire fee must keep a record of

is the person you authorize the department to contact as your

inventories each month under 15 AAC 98.090(a) and inventories

representative if the department has a question regarding the

must be reported on the quarterly return. Inventory should be

return.

kept for all tires, tires subject to the fee, studded tires subject to

the fee, and tires not subject to the fee.

Fee Calculation

Line 1 - Enter the total number of new tires sold in the state.

New Unstudded Tires Subject to the Tire Fee (Column A).

This includes all new tires manufactured for vehicles designed

Include in the total all new tires, whether studded or not and

for highway use. This does not include new studded tires (see

exempt tires reported on Line 2.

Column B) or off-road tires, used tires, or tires upon which the fee

has already been paid.

Line 2 - Enter the total number of new tires sold to exempt entities,

as summarized in Column D of the Supporting Schedule of

Exempt Tire Sales.

New Studded Tires Subject to the Tire Fee (Column B).

This includes all new studded tires manufactured for vehicles

designed for highway use. This does not include used studded

Line 3 - Enter the number of taxable new tires sold in the state.

tires or studded tires upon which the fee has already been paid.

This number is Line 1 less Line 2.

Total New Tires Subject to the Tire Fee (Column C).

Line 5 - Enter the total fees on new tires. Multiply Line 3 by Line 4.

This should equal column A plus column B.

Line 6 - Enter the total number of studded tires sold. Include

Line 1 - Enter the tire inventory on the first day of the quarter.

tires imbedded with metal studs or spikes weighing more than

This should equal the ending inventory from the last quarter. If

1.1 grams each. Include the number of exempt studded tires

this does not match, attach an explanation.

reported in Line 8.

Line 7 - Enter the total number of tire stud installation services

Line 2 - Enter all tires purchased, produced, or otherwise received

during the quarter.

performed. Include only installations of metal studs weighing

more than 1.1. grams each. Include the number of exempt stud

Line 3 - Enter all tires sold or transferred in the quarter, including

installations reported in Line 8.

all sales to exempt purchasers. The sum of Column A, Line 3 and

Column B, Line 3 should match Page 1, Line 1 for Tires Subject

Line 8 - Enter the total number of studded tires sold and tire

stud installations performed for exempt entities as summarized in

to the Fee, and Column B, Line 3 should match Page 1, Line 6

for Studded Tires Subject to the Fee. If it does not match, attach

Column E of the Supporting Schedule of Exempt Tire Sales.

an explanation.

Line 9 - Enter the total number of taxable studded tires and stud

Line 4 - Enter any adjustments to inventory not accounted for on

installations performed. Add Lines 6 and 7, subtract Line 8.

Lines 2 and 3. Attach an explanation.

Line 11 - Enter the total fees on studded tires and stud

installations. Multiply Line 9 by Line 10.

Supporting Schedule Of Exempt Tire Sales

Tire sellers must complete this schedule if they sold new tires,

Line 12 - Enter the total tire fees for all new tires sold, studded

studded tires, or performed stud installation services for exempt

tires sold and stud installations performed. Add Lines 5 and 11.

purchases, as provided by AS 43.98.025(g). The number of

exempt tires reported on the supporting schedule must agree

Line 13 - Enter 5% of the amount on Line 12. The amount cannot

with the number of exempt tires and services reported on Lines

exceed $900. Enter $0 if the tax amount due is not paid timely.

2 and 8 of the Tire Fees Quarterly Return (Form 200). You must

have a current year Tire Fees Certificate of Use (Form 201)

Line 14 - Enter the total tire fees due this quarter. Subtract Line

for each tax exempt purchaser entered in this section. This

certificate must be kept on hand for three years. Additional pages

13 from Line 12.

may be added as necessary.

Line 15 - Use this line only if this is an amended return for a

previous quarter. You must check the box at the top of the form

If You Need Help

to indicate that this is an amended return. Enter the amount from

If you have any questions, need additional information or

Line 16 (“Amount Due”) from the ORIGINAL tire fee return for this

require other assistance, call (907) 269-6620. Current forms,

quarter.

instructions, statutes and regulations are available online at www.

tax.alaska.gov.

Line 16 - Subtract Line 15 from Line 14. This is the amount due

for tire fees for the quarter.

Sign and date the return. The return must be signed by a

person authorized by law to act on behalf of the seller.

0405-200i - Rev 09/12 - page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2