Save

Reset

Print

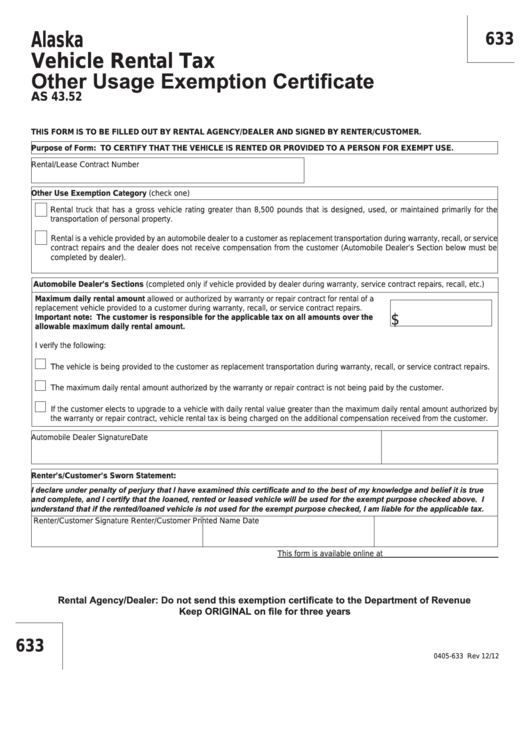

Alaska

633

Vehicle Rental Tax

Other Usage Exemption Certificate

AS 43.52

THIS FORM IS TO BE FILLED OUT BY RENTAL AGENCY/DEALER AND SIGNED BY RENTER/CUSTOMER.

Purpose of Form: TO CERTIFY THAT THE VEHICLE IS RENTED OR PROVIDED TO A PERSON FOR EXEMPT USE.

Rental/Lease Contract Number

Other Use Exemption Category (check one)

Rental truck that has a gross vehicle rating greater than 8,500 pounds that is designed, used, or maintained primarily for the

transportation of personal property.

Rental is a vehicle provided by an automobile dealer to a customer as replacement transportation during warranty, recall, or service

contract repairs and the dealer does not receive compensation from the customer (Automobile Dealer’s Section below must be

completed by dealer).

Automobile Dealer’s Sections (completed only if vehicle provided by dealer during warranty, service contract repairs, recall, etc.)

Maximum daily rental amount allowed or authorized by warranty or repair contract for rental of a

replacement vehicle provided to a customer during warranty, recall, or service contract repairs.

$

Important note: The customer is responsible for the applicable tax on all amounts over the

allowable maximum daily rental amount.

I verify the following:

The vehicle is being provided to the customer as replacement transportation during warranty, recall, or service contract repairs.

The maximum daily rental amount authorized by the warranty or repair contract is not being paid by the customer.

If the customer elects to upgrade to a vehicle with daily rental value greater than the maximum daily rental amount authorized by

the warranty or repair contract, vehicle rental tax is being charged on the additional compensation received from the customer.

Automobile Dealer Signature

Date

Renter’s/Customer’s Sworn Statement:

I declare under penalty of perjury that I have examined this certificate and to the best of my knowledge and belief it is true

and complete, and I certify that the loaned, rented or leased vehicle will be used for the exempt purpose checked above. I

understand that if the rented/loaned vehicle is not used for the exempt purpose checked, I am liable for the applicable tax.

Renter/Customer Signature

Renter/Customer Printed Name

Date

This form is available online at

Rental Agency/Dealer: Do not send this exemption certificate to the Department of Revenue

Keep ORIGINAL on file for three years

633

0405-633 Rev 12/12

1

1