Instructions For Form Dr-309638n - Exporter Fuel Tax Return

ADVERTISEMENT

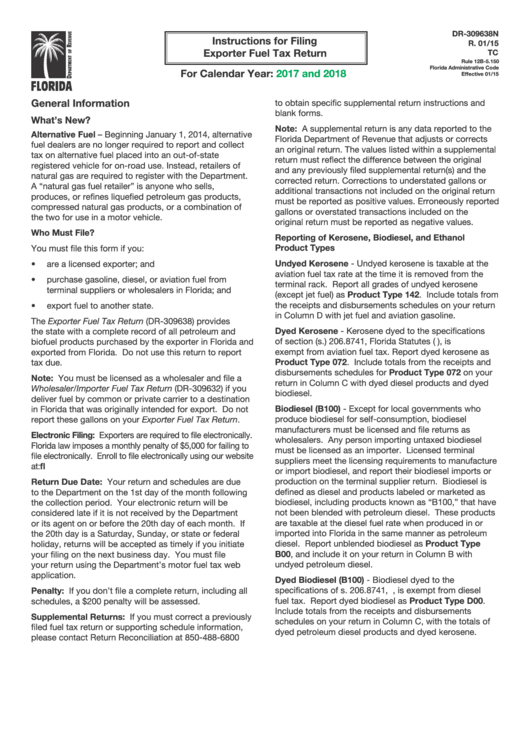

DR-309638N

Instructions for Filing

R. 01/15

Exporter Fuel Tax Return

TC

Rule 12B-5.150

Florida Administrative Code

For Calendar Year:

2017 and 2018

Effective 01/15

General Information

to obtain specific supplemental return instructions and

blank forms.

What’s New?

Note: A supplemental return is any data reported to the

Alternative Fuel – Beginning January 1, 2014, alternative

Florida Department of Revenue that adjusts or corrects

fuel dealers are no longer required to report and collect

an original return. The values listed within a supplemental

tax on alternative fuel placed into an out-of-state

return must reflect the difference between the original

registered vehicle for on-road use. Instead, retailers of

and any previously filed supplemental return(s) and the

natural gas are required to register with the Department.

corrected return. Corrections to understated gallons or

A “natural gas fuel retailer” is anyone who sells,

additional transactions not included on the original return

produces, or refines liquefied petroleum gas products,

must be reported as positive values. Erroneously reported

compressed natural gas products, or a combination of

gallons or overstated transactions included on the

the two for use in a motor vehicle.

original return must be reported as negative values.

Who Must File?

Reporting of Kerosene, Biodiesel, and Ethanol

Product Types

You must file this form if you:

Undyed Kerosene - Undyed kerosene is taxable at the

• are a licensed exporter; and

aviation fuel tax rate at the time it is removed from the

• purchase gasoline, diesel, or aviation fuel from

terminal rack. Report all grades of undyed kerosene

terminal suppliers or wholesalers in Florida; and

(except jet fuel) as Product Type 142. Include totals from

the receipts and disbursements schedules on your return

• export fuel to another state.

in Column D with jet fuel and aviation gasoline.

The Exporter Fuel Tax Return (DR-309638) provides

Dyed Kerosene - Kerosene dyed to the specifications

the state with a complete record of all petroleum and

of section (s.) 206.8741, Florida Statutes (F.S.), is

biofuel products purchased by the exporter in Florida and

exempt from aviation fuel tax. Report dyed kerosene as

exported from Florida. Do not use this return to report

Product Type 072. Include totals from the receipts and

tax due.

disbursements schedules for Product Type 072 on your

Note: You must be licensed as a wholesaler and file a

return in Column C with dyed diesel products and dyed

Wholesaler/Importer Fuel Tax Return (DR-309632) if you

biodiesel.

deliver fuel by common or private carrier to a destination

Biodiesel (B100) - Except for local governments who

in Florida that was originally intended for export. Do not

produce biodiesel for self-consumption, biodiesel

report these gallons on your Exporter Fuel Tax Return.

manufacturers must be licensed and file returns as

Electronic Filing: Exporters are required to file electronically.

wholesalers. Any person importing untaxed biodiesel

Florida law imposes a monthly penalty of $5,000 for failing to

must be licensed as an importer. Licensed terminal

file electronically. Enroll to file electronically using our website

suppliers meet the licensing requirements to manufacture

at: .

or import biodiesel, and report their biodiesel imports or

Return Due Date: Your return and schedules are due

production on the terminal supplier return. Biodiesel is

defined as diesel and products labeled or marketed as

to the Department on the 1st day of the month following

biodiesel, including products known as “B100,” that have

the collection period. Your electronic return will be

not been blended with petroleum diesel. These products

considered late if it is not received by the Department

are taxable at the diesel fuel rate when produced in or

or its agent on or before the 20th day of each month. If

imported into Florida in the same manner as petroleum

the 20th day is a Saturday, Sunday, or state or federal

diesel. Report unblended biodiesel as Product Type

holiday, returns will be accepted as timely if you initiate

B00, and include it on your return in Column B with

your filing on the next business day. You must file

undyed petroleum diesel.

your return using the Department’s motor fuel tax web

application.

Dyed Biodiesel (B100) - Biodiesel dyed to the

specifications of s. 206.8741, F.S., is exempt from diesel

Penalty: If you don’t file a complete return, including all

fuel tax. Report dyed biodiesel as Product Type D00.

schedules, a $200 penalty will be assessed.

Include totals from the receipts and disbursements

Supplemental Returns: If you must correct a previously

schedules on your return in Column C, with the totals of

filed fuel tax return or supporting schedule information,

dyed petroleum diesel products and dyed kerosene.

please contact Return Reconciliation at 850-488-6800

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4