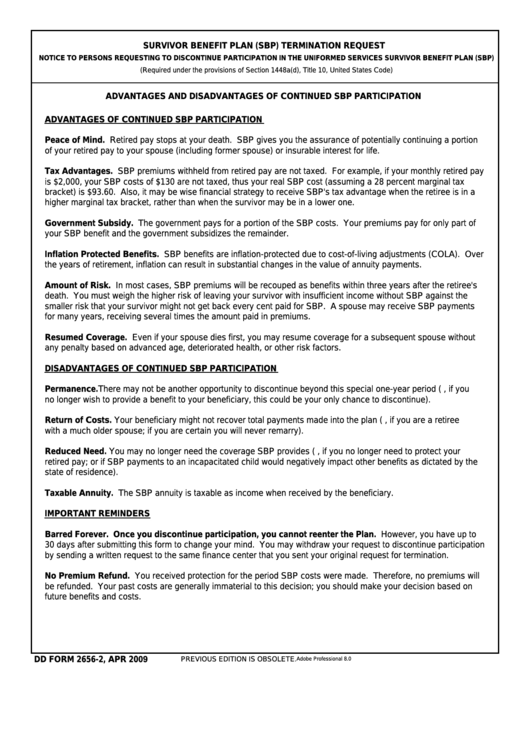

SURVIVOR BENEFIT PLAN (SBP) TERMINATION REQUEST

NOTICE TO PERSONS REQUESTING TO DISCONTINUE PARTICIPATION IN THE UNIFORMED SERVICES SURVIVOR BENEFIT PLAN (SBP)

(Required under the provisions of Section 1448a(d), Title 10, United States Code)

ADVANTAGES AND DISADVANTAGES OF CONTINUED SBP PARTICIPATION

ADVANTAGES OF CONTINUED SBP PARTICIPATION

Peace of Mind. Retired pay stops at your death. SBP gives you the assurance of potentially continuing a portion

of your retired pay to your spouse (including former spouse) or insurable interest for life.

Tax Advantages. SBP premiums withheld from retired pay are not taxed. For example, if your monthly retired pay

is $2,000, your SBP costs of $130 are not taxed, thus your real SBP cost (assuming a 28 percent marginal tax

bracket) is $93.60. Also, it may be wise financial strategy to receive SBP's tax advantage when the retiree is in a

higher marginal tax bracket, rather than when the survivor may be in a lower one.

Government Subsidy. The government pays for a portion of the SBP costs. Your premiums pay for only part of

your SBP benefit and the government subsidizes the remainder.

Inflation Protected Benefits. SBP benefits are inflation-protected due to cost-of-living adjustments (COLA). Over

the years of retirement, inflation can result in substantial changes in the value of annuity payments.

Amount of Risk. In most cases, SBP premiums will be recouped as benefits within three years after the retiree's

death. You must weigh the higher risk of leaving your survivor with insufficient income without SBP against the

smaller risk that your survivor might not get back every cent paid for SBP. A spouse may receive SBP payments

for many years, receiving several times the amount paid in premiums.

Resumed Coverage. Even if your spouse dies first, you may resume coverage for a subsequent spouse without

any penalty based on advanced age, deteriorated health, or other risk factors.

DISADVANTAGES OF CONTINUED SBP PARTICIPATION

Permanence. There may not be another opportunity to discontinue beyond this special one-year period (i.e., if you

no longer wish to provide a benefit to your beneficiary, this could be your only chance to discontinue).

Return of Costs. Your beneficiary might not recover total payments made into the plan (e.g., if you are a retiree

with a much older spouse; if you are certain you will never remarry).

Reduced Need. You may no longer need the coverage SBP provides (e.g., if you no longer need to protect your

retired pay; or if SBP payments to an incapacitated child would negatively impact other benefits as dictated by the

state of residence).

Taxable Annuity. The SBP annuity is taxable as income when received by the beneficiary.

IMPORTANT REMINDERS

Barred Forever. Once you discontinue participation, you cannot reenter the Plan. However, you have up to

30 days after submitting this form to change your mind. You may withdraw your request to discontinue participation

by sending a written request to the same finance center that you sent your original request for termination.

No Premium Refund. You received protection for the period SBP costs were made. Therefore, no premiums will

be refunded. Your past costs are generally immaterial to this decision; you should make your decision based on

future benefits and costs.

DD FORM 2656-2, APR 2009

PREVIOUS EDITION IS OBSOLETE.

Adobe Professional 8.0

1

1 2

2