Form Dr 1002 - Colorado Sales/use Tax Rates Page 2

ADVERTISEMENT

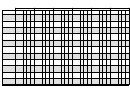

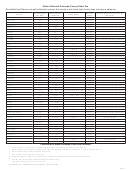

Local Improvement District Tax (LID)

LID sales tax is remitted in the city/LID column on the DR 0100, "Retail Sales Tax Return." Use tax is not applicable.

See DR 1250 for exemption explanation.

Sales

Service

LID

Boundaries

Tax

Fee

Exemptions

Rate

Allowed

Boulder County

Old Town Niwot and Cottonwood Square

1%

0

A-I-J

Douglas County

Lincoln Station

0.50%

0

I-J

Southeast Jefferson

Within designated areas of Southeast Jefferson County

0.50%

3 1/3%

I-J

Southeast Jefferson County

Within designated areas of Southeast Jefferson County

0.43%

3 1/3%

I-J

within Lakewood City limits

with Lakewood City Limits

Broomfield City and County

Flatirons Crossing Mall area collected by Broomfield

0.01%

Broomfield City and County

Arista collected by Broomfield

0.20%

Mesa County Gateway

Within designated areas of unincorporated Mesa County

1%

0

I-J

Mesa County Whitewater

Within designated areas of unincorporated Mesa County

1%

0

I-J

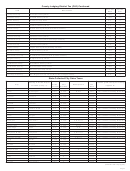

Mass Transportation System Tax (MTS)

MTS sales tax is remitted in the county/MTS column on the DR 0100, "Retail Sales Tax Return.”

MTS

Boundaries

Sales Tax Rate Service Fee Allowed

Exemptions

Use Tax Rate

Use Tax Applies

Eagle County

Eagle County limits

0.5%

3 1/3%

A, B, C, K

None

Pitkin County

Pitkin County limits

0.5%

0

0.5%

Motor Vehicles,

Building Materials

Summit County

Summit County limits

0.75%

3 1/3%

None

Regional Transportation Authority (RTA)

RTA sales tax is remitted in the special district column on the DR 0100, “Retail Sales Tax Return." RTA use tax is remitted

on the DR 0173, "Retailer’s Use tax Return." The Baptist Road RTA sales/use tax expired on June 30, 2016. The Baptist

Road RTA will be remitted on the DR 0200 "Special Districts Sales Tax Return Supplement."

Service

Use

Sales Tax

RTA

Boundaries

Fee

Exemptions

Tax

Rate

Rate

Allowed

Gunnison Valley

Gunnison County except the towns of Marble,

1%

0

A,B,C,D,E,G,H,K,L,M,N,O,P,Q

None

Ohio, Pitkin and Somerset

Pikes Peak

El Paso County limits except the municipalities of

1%

0

A,B,C,D,E,G,H,K,L,M,N,O,P,Q

1%

Calhan, Fountain, Monument, Palmer Lake and

the Commercial Aeronautical Zone in the City of

Colorado Springs. Any areas annexed into these

municipalities after 2004 are included in the PPRTA.

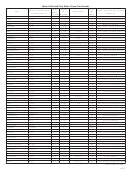

Roaring Fork

Basalt and New Castle city limits

0.8%

0

A,B,C,D,E,G,H,K,L,M,N,O,P,Q

0.8%

Carbondale and Glenwood Springs limits

1%

0

A,B,C,D,E,G,H,K,L,M,N,O,P,Q

1%

Aspen and Snowmass Village city limits,

0.4%

0

A,B,C,D,E,G,H,K,L,M,N,O,P,Q

0.4%

unincorporated Pitkin County

Areas of unincorporated Eagle County in the El

0.6%

0

A,B,C,D,E,G,H,K,L,M,N,O,P,Q

0.6%

Jebel area and outside the city limits of Carbondale

San Miguel Authority

Mountain Village and Telluride city limits, portion of

0.25%

0

A,B,C,D,E,G,H,K,L,M,N,O,P,Q

None

for Regional

unincorporated San Miguel County except for the

Transportation

towns of Ophir and Sawpit

South Platte Valley

Sterling city limits

0.1%

0

A,B,C,D,E,G,H,K,L,M,N,O,P,Q

0.1%

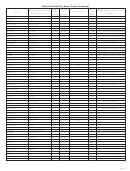

Multi-Jurisdictional Housing Authority (MHA)

MHA sales tax is remitted in the special district column on the DR 0100, “Retail Sales Tax Return." MHA use tax is

collected at the time of titling/registration at the county motor vehicle office.

MHA

Boundaries

Sales Tax Rate Service Fee Allowed

Exemptions

Use Tax Rate

Summit Combined

Summit County Limits

0.725%

3 1/3%

A,B,C,D,E,G,H,K,L,M,N,O,P,Q

0.125%

Housing Authority

(Vehicles Only)

Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10