Wholesale Drug Distributor Tax Instructions - Minnesota Department Of Revenue - 2016

ADVERTISEMENT

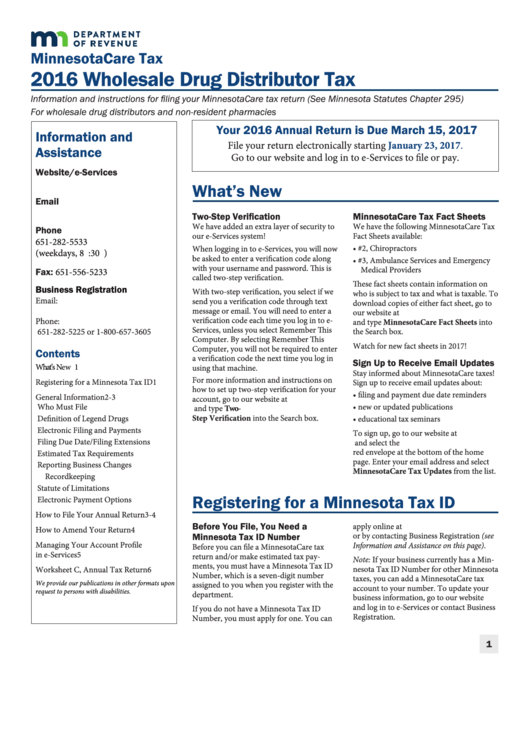

MinnesotaCare Tax

2016 Wholesale Drug Distributor Tax

Information and instructions for filing your MinnesotaCare tax return (See Minnesota Statutes Chapter 295)

For wholesale drug distributors and non-resident pharmacies

Your 2016 Annual Return is Due March 15, 2017

Information and

January 23, 2017.

File your return electronically starting

Assistance

Go to our website and log in to e-Services to file or pay.

Website/e-Services

What’s New

Email

MinnesotaCare.tax@state.mn.us

Two-Step Verification

MinnesotaCare Tax Fact Sheets

We have added an extra layer of security to

We have the following MinnesotaCare Tax

Phone

our e-Services system!

Fact Sheets available:

651-282-5533

• #2, Chiropractors

When logging in to e-Services, you will now

(weekdays, 8 a.m.-4:30 p.m.)

be asked to enter a verification code along

• #3, Ambulance Services and Emergency

with your username and password. This is

Medical Providers

651-556-5233

Fax:

called two-step verification.

These fact sheets contain information on

Business Registration

With two-step verification, you select if we

who is subject to tax and what is taxable. To

Email:

send you a verification code through text

download copies of either fact sheet, go to

business.registration@state.mn.us

message or email. You will need to enter a

our website at

verification code each time you log in to e-

Phone:

and type MinnesotaCare Fact Sheets into

Services, unless you select Remember This

651-282-5225 or 1-800-657-3605

the Search box.

Computer. By selecting Remember This

Watch for new fact sheets in 2017!

Computer, you will not be required to enter

Contents

a verification code the next time you log in

Sign Up to Receive Email Updates

What’s

New . . . . . . . . . . . . . . . . . . . . . . . 1

using that machine.

Stay informed about MinnesotaCare taxes!

For more information and instructions on

Registering for a Minnesota Tax ID . . . .1

Sign up to receive email updates about:

how to set up two-step verification for your

• filing and payment due date reminders

General Information . . . . . . . . . . . . . . .2-3

account, go to our website at

Who Must File

• new or updated publications

and type Two-

Step Verification into the Search box.

Definition of Legend Drugs

• educational tax seminars

Electronic Filing and Payments

To sign up, go to our website at

Filing Due Date/Filing Extensions

and select the

red envelope at the bottom of the home

Estimated Tax Requirements

page. Enter your email address and select

Reporting Business Changes

MinnesotaCare Tax Updates from the list.

Recordkeeping

Statute of Limitations

Registering for a Minnesota Tax ID

Electronic Payment Options

How to File Your Annual Return . . . .3-4

Before You File, You Need a

apply online at

How to Amend Your Return . . . . . . . . . .4

or by contacting Business Registration (see

Minnesota Tax ID Number

Managing Your Account Profile

Information and Assistance on this page).

Before you can file a MinnesotaCare tax

in e-Services . . . . . . . . . . . . . . . . . . . . . . . .5

return and/or make estimated tax pay-

Note: If your business currently has a Min-

ments, you must have a Minnesota Tax ID

nesota Tax ID Number for other Minnesota

Worksheet C, Annual Tax Return . . . . . .6

Number, which is a seven-digit number

taxes, you can add a MinnesotaCare tax

We provide our publications in other formats upon

assigned to you when you register with the

account to your number. To update your

request to persons with disabilities.

department.

business information, go to our website

and log in to e-Services or contact Business

If you do not have a Minnesota Tax ID

Registration.

Number, you must apply for one. You can

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6