Airline Flight Property Tax Instructions - Minnesota Department Of Revenue

ADVERTISEMENT

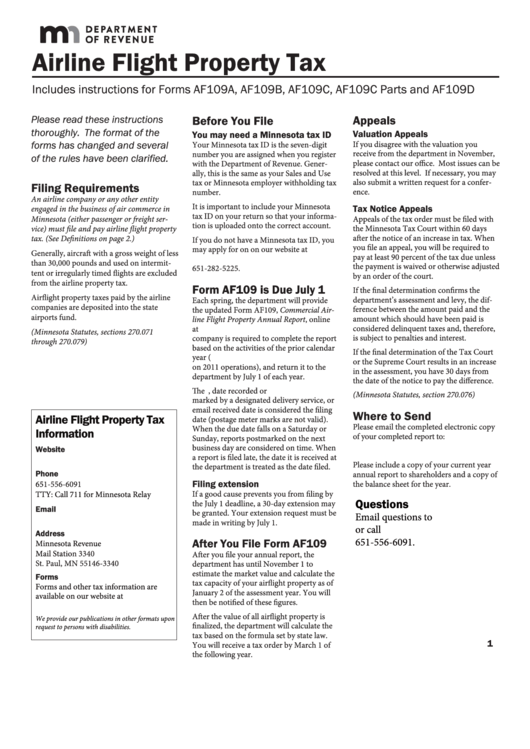

Airline Flight Property Tax

Includes instructions for Forms AF109A, AF109B, AF109C, AF109C Parts and AF109D

Please read these instructions

Appeals

Before You File

thoroughly. The format of the

Valuation Appeals

You may need a Minnesota tax ID

forms has changed and several

If you disagree with the valuation you

Your Minnesota tax ID is the seven-digit

receive from the department in November,

number you are assigned when you register

of the rules have been clarified.

please contact our office. Most issues can be

with the Department of Revenue. Gener-

resolved at this level. If necessary, you may

ally, this is the same as your Sales and Use

also submit a written request for a confer-

tax or Minnesota employer withholding tax

Filing Requirements

ence.

number.

An airline company or any other entity

It is important to include your Minnesota

Tax Notice Appeals

engaged in the business of air commerce in

tax ID on your return so that your informa-

Minnesota (either passenger or freight ser-

Appeals of the tax order must be filed with

tion is uploaded onto the correct account.

vice) must file and pay airline flight property

the Minnesota Tax Court within 60 days

after the notice of an increase in tax. When

tax. (See Definitions on page 2.)

If you do not have a Minnesota tax ID, you

you file an appeal, you will be required to

may apply for on on our website at

Generally, aircraft with a gross weight of less

pay at least 90 percent of the tax due unless

or by calling

than 30,000 pounds and used on intermit-

the payment is waived or otherwise adjusted

651-282-5225.

tent or irregularly timed flights are excluded

by an order of the court.

from the airline property tax.

Form AF109 is Due July 1

If the final determination confirms the

Airflight property taxes paid by the airline

department’s assessment and levy, the dif-

Each spring, the department will provide

companies are deposited into the state

ference between the amount paid and the

the updated Form AF109, Commercial Air-

airports fund.

amount which should have been paid is

line Flight Property Annual Report, online

considered delinquent taxes and, therefore,

at . Each airline

(Minnesota Statutes, sections 270.071

is subject to penalties and interest.

company is required to complete the report

through 270.079)

based on the activities of the prior calendar

If the final determination of the Tax Court

year (i.e. the 2012 airflight report is based

or the Supreme Court results in an increase

on 2011 operations), and return it to the

in the assessment, you have 30 days from

department by July 1 of each year.

the date of the notice to pay the difference.

The U.S. postmark date, date recorded or

(Minnesota Statutes, section 270.076)

marked by a designated delivery service, or

email received date is considered the filing

Where to Send

Airline Flight Property Tax

date (postage meter marks are not valid).

Please email the completed electronic copy

When the due date falls on a Saturday or

Information

of your completed report to:

Sunday, reports postmarked on the next

business day are considered on time. When

Website

sa.property@state.mn.us

a report is filed late, the date it is received at

Please include a copy of your current year

the department is treated as the date filed.

Phone

annual report to shareholders and a copy of

Filing extension

the balance sheet for the year.

651-556-6091

If a good cause prevents you from filing by

TTY: Call 711 for Minnesota Relay

Questions

the July 1 deadline, a 30-day extension may

Email

be granted. Your extension request must be

Email questions to

sa.property@state.mn.us

made in writing by July 1.

sa.property@state.mn.us or call

Address

651-556-6091.

After You File Form AF109

Minnesota Revenue

Mail

Station 3340

After you file your annual report, the

St. Paul, MN 55146-3340

department has until November 1 to

estimate the market value and calculate the

Forms

tax capacity of your airflight property as of

Forms and other tax information are

January 2 of the assessment year. You will

available on our website at

then be notified of these figures.

.

After the value of all airflight property is

We provide our publications in other formats upon

finalized, the department will calculate the

request to persons with disabilities.

tax based on the formula set by state law.

1

You will receive a tax order by March 1 of

the following year.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4