IT-541 (1/15)

LDR Account Number:

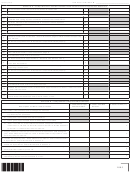

Computation of Income

9

Total tax – See Worksheet 1 - Calculation of Income Tax

9

Resident Trust credit for net income taxes paid to a state other than Louisiana - A copy of the

10

10

other state’s return must be submitted.

11 Other nonrefundable income tax credits – From Schedule NRC, Line 10

11

12 Total income tax after nonrefundable credits - Subtract Lines 10 and 11 from Line 9.

12

13 Louisiana Citizens Insurance Credit – See instructions.

13

14 Other refundable credits – From Schedule RC, Line 6

14

15 Amount of credit carried forward from 2013

15

Nonresident only: Amount paid on your behalf by a Composite Partnership Filing

16

16

Enter name of partnership ____________________________________________________

17 Amount of Louisiana Tax Withheld For 2014 - Attach Forms W-2 and 1099.

17

Amount of Estimated Payments for 2014 and Amount Paid with Extension Request - From

18

18

Schedule E, Line 6

19 Total Refundable Tax Credits and Payments – Add Lines 13 through 18.

19

Overpayment – If Line 19 is greater than Line 12, subtract Line 12 from Line 19. Otherwise,

20

20

go to Line 23.

21 Amount of Line 20 to be credited to 2015 Income tax

21

22 Amount to be refunded – Subtract Line 21 from Line 20.

22

23 Amount owed – If Line 12 is greater than Line 19, subtract Line 19 from Line 12.

23

24 Interest – From the Interest Calculation Worksheet, page 15, Line 5.

24

Delinquent filing penalty – From the Delinquent Filing Penalty Calculation Worksheet,

25

25

page 15, Line 7.

Delinquent payment penalty – From the Delinquent Payment Penalty Calculation Worksheet,

26

26

page 15, Line 7.

PAY THIS AMOUNT.

27 Total amount due (Add Lines 23 through 26.)

27

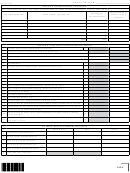

Under the penalties of perjury, I declare that I have examined this return, including all accompanying documents, and to the best of my knowledge and belief,

it is true, correct, and complete. If prepared by a person other than taxpayer, his declaration is based on all information of which he has any knowledge.

Signature of fiduciary or officer representing fiduciary

Telephone

Date

(mm/dd/yyyy)

Address

City

State

ZIP

Signature of preparer other than fiduciary

Telephone

Date

(mm/dd/yyyy)

Address

City

State

ZIP

FOR OFFICE USE ONLY

SPEC

Field

1802

CODE

Flag

1

1 2

2 3

3 4

4 5

5