IT-541 (1/15)

LDR Account Number:

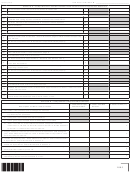

Schedule NRC – Nonrefundable Tax Credits and Exemptions (For further information about these credits, please see instructions beginning on page 9.)

Description

Code

Amount of Credit Claimed

1

1

2

2

3

3

4

4

5

5

6

6

7

7

8

8

9

9

10

Total Income Tax Credits: Add Lines 1 through 9. Enter the result here and on IT-541, Line 11.

10

Description

Code

Description

Code

Description

Code

Description

Code

Other

La Community Economic Dev

Premium Tax

234

LCDFI Credit

100

199

258

Atchafalaya Trace

Apprenticeship

236

Bone Marrow

120

200

New Markets

259

Ports of Louisiana Investor

Nonviolent Offenders

Previously Unemployed

238

Brownfields Investor

140

208

260

Recycling Credit

Qualified Playgrounds

150

210

Ports of Louisiana Import

Motion Picture Infrastructure

261

240

Debt Issuance

Basic Skills Training

Export Cargo

Angel Investor

155

212

262

New Jobs Credit

224

Motion Picture Investment

Other

299

Contributions to Educational

251

160

Refunds by Utilities

Biomed/University Research

Institutions

226

Research and Development

252

300

Eligible Re-entrants

Tax Equalization

Donations to Public Schools

228

Historic Structures

253

305

170

Neighborhood Assistance

230

Digital Interactive Media

Manufacturing Establishments

310

Donations of Materials, Equip-

254

175

Cane River Heritage Area

Enterprise Zone

ment, Advisors, Instructors

232

Motion Picture Resident

256

315

Capital Company

Other

399

257

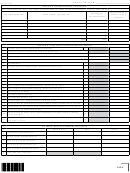

Schedule RC – Refundable Tax Credits (For further information about these credits, please see instructions beginning on page 12.)

Description

Code

Amount of Credit Claimed

1

1

2

2

3

3

4

4

5

5

6

Total: Add lines 1 through 5. Print the result here and on IT-541, Line 14.

6

Description

Code

Description

Code

Description

Code

Description

Code

Inventory Tax

50F

Urban Revitalization

56F

School Readiness Business -

Digital Interactive Media and

67F

73F

51F

57F

Ad Valorem Natural Gas

Mentor-Protégé

Supported Child Care

Software

Ad Valorem Offshore Vessels

52F

Milk Producers

58F

Leased Solar Energy Systems

74F

School Readiness Fees and

54F

Telephone Company Property

Technology Commercialization

59F

Other Refundable

80F

Grants to Resource and

68F

Prison Industry Enhancement

55F

Angel Investor

61F

Referral Agencies

Musical & Theatrical Production

62F

70F

Retention and Modernization

Solar Energy Systems -

Conversion of Vehicle to

64F

71F

Non-Leased

Alternative Fuel

1803

School Readiness Child Care

Research and Development

72F

65F

Provider

1

1 2

2 3

3 4

4 5

5