_____________________________

LDR Account Number u

IT-541 (1/15)

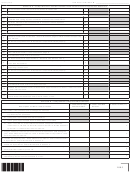

Schedule C – Distributive Shares of Beneficiaries

Social Security Number, Name, and Address of each beneficiary as shown on their individual income tax return IT-540 or IT-540B

Distributive Share of

Percentage of

Social Security Number

Name, Address, City, State, ZIP

Louisiana income to

Beneficial Interest

beneficiary

a.

%

b.

%

c.

%

d.

%

e.

%

f.

%

Total

100%

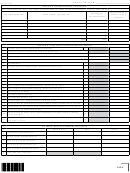

Schedule D – Computation of Federal Income Tax Deduction

1

Louisiana income before federal income tax deduction

1

Adjustment to convert Louisiana net income to a federal basis:

2

Net Adjustment

2

3

Louisiana income on a federal basis - Subtract Line 2 from Line 1.

3

4

Less Louisiana income taxed at special rates

4

5

Louisiana ordinary income on a federal basis - Subtract Line 4 from Line 3.

5

6

Federal taxable income

6

7

Less federal income taxed at special rates

7

8

Federal net income - Ordinary - Subtract Line 7 from Line 6.

8

9

Ratio–Louisiana Ordinary/Federal Ordinary - Divide Line 5 by Line 8.

9

10

Ratio–Louisiana Special/Federal Special - Divide Line 4 by Line 7.

10

11

Federal income tax liability

11

12

Less federal special rates tax

12

13

Less alternative minimum tax

13

14

Federal ordinary tax - Subtract Lines 12 and 13 from Line 11.

14

15

Federal income tax attributable to Louisiana ordinary income - Multiply Line 14 by Line 9.

15

16

Federal income tax on Louisiana income taxed at special rates - Multiply Line 12 by Line 10.

16

17

Federal income tax disaster relief credits

17

Federal income tax disaster relief credits attributable to Louisiana Louisiana - Multiply

18

18

Line 17 by Line 9.

Federal income tax deduction - Add Lines 15, 16, and 18. Enter the result here and on

19

19

Form IT-541, Line 7A.

Schedule E– Summary of Estimated Tax Payments

Check Number

Date

Amount

1

First quarter estimated payment

2

Second quarter estimated payment

3

Third quarter estimated payment

4

Fourth quarter estimated payment

5

Payment made with extension request

6

Total – Add Lines 1 through 5.

1806

1

1 2

2 3

3 4

4 5

5