Form Dr-309639 - Application For Refund Of Tax Paid On Undyed Diesel Used For Off-Road Or Other Exempt Purposes Page 3

ADVERTISEMENT

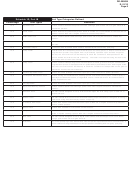

DR-309639

R. 01/13

Page 3

Schedule 1A

Schedule of Purchase of Tax-paid Undyed Diesel Fuel

You must complete and include this schedule with your application to qualify for the refund. In addition, the following information must be made

available upon request to validate proof of purchase and taxes paid.

• Invoice from retail station where undyed diesel was purchased and placed directly into the supply tank of a qualifying motor vehicle.

• Invoice from bulk fuel provider. If fuel is placed into qualifying vehicles from bulk storage, you must maintain the original proof of purchase

and you must include a daily withdrawal summary of tax-paid fuel for each vehicle with your refund claim.

Applicant Name

FEIN

Invoiced Through Date

(1)

(2)

(3)

(4)

(5)

(6)

Name of Supplier

Supplier FEIN/DEP Number

Date Received

Invoice Number

Gallons Invoiced

Invoiced Price Including Tax

TOTALS

Schedule 1B

Average Cost per Gallon Computation

1

Total State and Local Option Fuel Tax Paid on Fuel Purchases:

$

(Total of Column 5 from Schedule 1A multiplied by $.318)

2.

Total Cost of Purchased Fuel Less State and Local Option Tax:

$

(Total of Column 6 from Schedule 1A minus Line 1 from Schedule 1B)

3.

Average Cost per Gallon:

$

(Total of Line 2 from Schedule 1B divided by Column 5 from Schedule 1A), carried out four decimal

places

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10