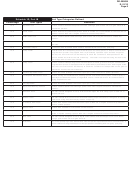

Form Dr-309639 - Application For Refund Of Tax Paid On Undyed Diesel Used For Off-Road Or Other Exempt Purposes Page 4

ADVERTISEMENT

DR-309639

R. 01/13

Page 4

Computation of Sales Tax Due by County

Schedule 1C

License No.:

Period:

/

/

to

/

/

Name:

(Choose one. Use a separate schedule for each applicable

Category:

A

B

C

D

category. See Page 2 for explanation of categories.)

GALLONS

*ACPG

GALLONS

*ACPG

SUBJECT

FROM

SALES TAX

SUBJECT

FROM

SALES TAX

RATE

RATE

TO SALES

SCHEDULE

DUE

TO SALES

SCHEDULE

DUE

COUNTY

COUNTY

TAX

1B

TAX

1B

GALLONS

X

ACPG

X

RATE

=

SALES TAX

GALLONS

X

ACPG

X

RATE

=

SALES TAX

DUE

DUE

11

ALACHUA

0.065

45

LAKE

0.07

12

BAKER

0.07

46

LEE

0.06

13

BAY

0.07

47

LEON

0.075

14

BRADFORD

0.07

48

LEVY

0.07

15

BREVARD

0.07

49

LIBERTY

0.08

16

BROWARD

0.06

50

MADISON

0.075

17

CALHOUN

0.075

51

MANATEE

0.07

18

CHARLOTTE

0.07

52

MARION

0.07

19

CITRUS

0.06

53

MARTIN

0.06

20

CLAY

0.07

54

MONROE

0.075

21

COLLIER

0.06

55

NASSAU

0.07

22

COLUMBIA

0.07

56

OKALOOSA

0.06

23

DADE

0.07

57

OKEECHOBEE

0.07

(MIAMI-DADE)

24

DESOTO

0.075

58

ORANGE

0.065

25

DIXIE

0.07

59

OSCEOLA

0.075

26

DUVAL

0.07

60

PALM BEACH

0.07

27

ESCAMBIA

0.075

61

PASCO

0.07

28

FLAGLER

0.07

62

PINELLAS

0.07

29

FRANKLIN

0.07

63

POLK

0.07

30

GADSDEN

0.075

64

PUTNAM

0.07

31

GILCHRIST

0.07

65

ST. JOHNS

0.065

32

GLADES

0.07

66

ST. LUCIE

0.065

33

GULF

0.07

67

SANTA ROSA

0.07

34

HAMILTON

0.07

68

SARASOTA

0.07

35

HARDEE

0.07

69

SEMINOLE

0.07

36

HENDRY

0.07

70

SUMTER

0.07

37

HERNANDO

0.065

71

SUWANNEE

0.07

38

HIGHLANDS

0.075

72

TAYLOR

0.07

39

HILLSBOROUGH

0.07

73

UNION

0.07

40

HOLMES

0.07

74

VOLUSIA

0.065

41

INDIAN RIVER

0.07

75

WAKULLA

0.07

42

JACKSON

0.075

76

WALTON

0.07

43

JEFFERSON

0.07

77

WASHINGTON

0.07

44

LAFAYETTE

0.07

TOTAL

*AVERAGE COST PER GALLON

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10