DR-405, R. 01/18, Page 4

LINE INSTRUCTIONS

Within each section, group your assets by year of acquisition. List each item of property separately except for “classes”

of personal property. A class is a group of items substantially similar in function, use, and age.

Line 14 - Farm, Grove, and Dairy Equipment

List all types of agricultural equipment you owned on January 1. Describe property by type, manufacturer, model

number, and year acquired. Examples: bulldozers, draglines, mowers, balers, tractors, all types of dairy equipment,

pumps, irrigation pipe - show feet of main line and sprinklers, hand and power sprayers, heaters, discs, fertilizer

distributors.

Line 16 and 16a - Hotel, Motel, Apartment and Rental Units (Household Goods)

List all household goods. Examples: furniture, appliances, and equipment used in rental or other commercial property.

Both residents and nonresidents must report if a house, condo, apartment, etc. is rented at any time during the year.

Line 17 - Mobile Home Attachments

For each type of mobile home attachment (awnings, carports, patio roofs, trailer covers, screened porches or rooms,

cabanas, open porches, utility rooms, etc.), enter the number of items you owned on January 1, the year of purchase,

the size (length X width), and the original installed cost.

Line 20 - Leasehold Improvements, Physical Modifications to Leased Property

If you have made any improvements, including modifications and additions, to property that you leased, list the original

cost of the improvements. Group them by type and year of installation. Examples: slat walls, carpeting, paneling,

shelving, cabinets. Attach an itemized list or depreciation schedule of the individual improvements.

Line 22 - Owned by you but rented to another

Enter any equipment you own that is on a loan, rental, or lease basis to others.

Line 23 - Supplies

Enter the average cost of supplies that are on hand. Include expensed supplies, such as stationery and janitorial

supplies, linens, and silverware, which you may not have recorded separately on your books.

Include items you carry in your inventory account but do not meet the definition of “inventory” subject to exemption.

Line 24 - Renewable Energy Source Devices

List all renewable energy source devices as defined in section 193.624, Florida Statutes. Section 196.182, F.S., provides

an exemption to renewable energy source devices considered tangible personal property. The exemption is granted

based on a percentage of value, when the devices are installed, and what type of property the devices are installed on.

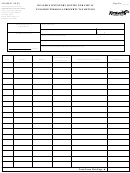

COLUMN INSTRUCTIONS

List all items of furniture, fixtures, all machinery, equipment, supplies, and certain types of equipment attached to mobile

homes. For each item, you must report your estimate of the current fair market value and condition of the item (good,

average, poor). Enter all expensed items at original installed cost. Do not use “various” or “same as last year” in any of

the columns. These are not adequate responses and may subject you to penalties for failure to file.

Taxpayer's Estimate of Fair Market Value

You must report the taxpayer's estimate of fair market value of the property in the columns labeled "Taxpayer's Estimate

of Fair Market Value." The amount reported is your estimate of the current fair market value of the property.

Original Installed Cost

Report 100% of the original total cost of the property in the columns labeled "Original Installed Cost." This cost includes

sales tax, transportation, handling, and installation charges, if incurred. Enter only unadjusted figures in "Original

Installed Cost" columns.

The original cost must include the total original installed cost of your equipment, before any allowance for depreciation.

Include sales tax, freight- in, handling, and installation costs. If you deducted a trade-in from the invoice price, enter the

invoice price. Add back investment credits taken for federal income tax if you deducted those from the original cost.

Include all fully depreciated items at original cost, whether written off or not.

Assets Physically Removed

If you physically removed assets last year, complete the columns in the first section of page 2. If you sold, traded, or

gave property to another business or person, include the name in the last column.

Leased, Loaned, and Rented Equipment

If you borrowed, rented, or leased equipment from others, enter the name and address of the owner or lessor in the

second section of page 2. Include a description of the equipment, year you acquired it, year of manufacture (if known),

the monthly rent, the amount it would have originally cost had you bought it new, and indicate if you have an option to

buy the equipment at the end of the term.

1

1 2

2 3

3 4

4