Form Gt-800036 - Secondhand Dealers And Secondary Metals Recyclers Page 2

ADVERTISEMENT

Salvage Motor Vehicle Dealer – A business that engages in the business of acquiring salvaged or

wrecked motor vehicles for the purpose of reselling them and their parts. Salvage motor vehicle

dealers must register with the Department of Highway Safety and Motor Vehicles (DHSMV) for a

salvage motor vehicle dealer license ( ). (See section [s.] 320.27, F.S.)

Registration Requirements

Before engaging in business in Florida, every person or business entity who purchases or sells

secondhand goods, precious metals, or metals for conversion to raw material products must register

with the Florida Department of Revenue:

as a sales and use tax dealer to collect and report sales tax and any applicable

discretionary sales surtax, and

as a secondhand dealer or secondary metals recycler.

Complete a Florida Business Tax Application (Form DR-1). A separate application is required for:

•

Each county where secondhand goods are purchased, consigned, or traded and at each

business location where secondhand goods are sold;

•

Each county where an automated kiosk is operated;

•

Each business location where secondary metals are purchased, gathered, or obtained; and

•

Each secondary metals recycler business location where ferrous and nonferrous metals are

converted into raw products.

You can register to collect and report tax through our website. The site will guide you through an

application interview that will help you determine your tax obligations. If you do not have Internet

access, you can complete a paper Florida Business Tax Application (Form DR-1). The registration

fee for a paper application is $5; however, there is no fee for registering online.

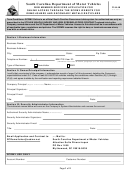

Complete a Registration Application for Secondhand Dealers and Secondary Metals Recyclers

(Form DR-1S) to register one or more of your business locations as a secondhand dealer or

secondary metals recycler. The registration processing fee is $6 for each license at each location.

Any person who engages in business as a pawnbroker must register with the Department of Revenue

to collect and report sales tax and surtax. Pawnbrokers are not required to register as a secondhand

dealer.

Any salvage motor vehicle dealer that dismantles and converts motor vehicles into scrap metal

must register with the Department of Revenue as a secondary metals recycler.

Any person who is in the business of purchasing, consigning, or trading secondhand goods at a flea

market (temporary or permanent business location) must obtain a Secondhand Dealer Certificate of

Registration (Form DR-11S) for the flea market location, unless the business has registered as a

secondhand dealer in the same county as the flea market. The business must also obtain a sales

and use tax Certificate of Registration (Form DR-11) for the flea market business location.

After we approve your registration, you will receive a Certificate of Registration (Form DR-11) and a

Florida Annual Resale Certificate for Sales Tax (Form DR-13). If you are not filing electronically, we

will mail paper tax returns to you. The Florida Annual Resale Certificate for Sales Tax is used for tax-

exempt purchases you intend to resell. If the goods bought for resale are later used (not resold),

you must report and pay use tax and surtax on those items. Florida law provides for criminal and

civil penalties for fraudulent use of a Florida Annual Resale Certificate for Sales Tax.

Florida Department of Revenue, Secondhand Dealers, Mail-in Secondhand Precious

Metals Dealers, and Secondary Metals Recyclers, Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5