Form Gt-800036 - Secondhand Dealers And Secondary Metals Recyclers Page 3

ADVERTISEMENT

Are There Any Exemptions from the Registration Requirements?

Yes. Florida law exempts certain types of businesses and transactions that are not subject to the

registration requirements for secondhand dealers and secondary metals recyclers. See ss. 538.03,

538.22, and 538.31, F.S., for additional transactions that are not subject to Florida law regarding

secondhand dealers and secondary metals recyclers.

Who is Not Required to Register as a Secondhand Dealer?

•

Pawnbrokers

•

Any nonprofit, religious, charitable organization or school-sponsored association or

organization

•

Garage sale operators who hold less than 10 garage sales per year

•

Any person accepting a secondhand good as a trade-in for a similar item of greater value

•

Any person offering items for sale, purchase, consignment, or trade via an Internet website

who is not required to have a local occupational or business license to offer these items

•

Any business that primarily buys, sells, or trades motion picture videos and video games

that meets the requirements of s. 538.03(2)(o), F.S.

•

Any business registered with the Department for sales tax as an antique dealer that meets

the requirements of s. 538.03(2)(l), F.S.

•

Any auction business defined in s. 468.382, F.S., operating as an auction business in

the buying and selling of estates, business inventory, surplus merchandise, or business

liquidations

Who is Not Required to Register as a Mail-in Secondhand Precious Metals Dealer?

•

Any registered secondhand dealer available to the public for walk-in business.

Who is Not Required to Register as a Secondary Metals Recycler?

•

Any religious, fraternal, civic, patriotic, social, or school-sponsored organization or

association or any nonprofit corporation or association.

•

Any vendor that generates regulated materials in the ordinary course of business.

Criminal History Record Check

Applicants submitting an initial (“new business”) secondhand dealer or secondary metals recycler

registration are required to undergo a criminal history record check. Each business owner, officer,

member, director, partner, and stockholder with a controlling interest in a business must undergo the

record check.

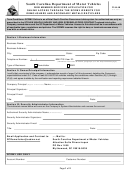

Business owners may submit a Registration Application for Secondhand Dealers and Secondary

Metals Recyclers (Form DR-1S) for additional locations without undergoing a new criminal history

record check if they hold an active certificate of registration as a secondhand dealer or secondary

metals recycler.

Employees of secondhand dealers or secondary metals recyclers with no controlling interest,

financial or otherwise, do not have to undergo a criminal history record check.

A director with no ability to control the company may submit a letter signed by an active principal

corporate officer (president, vice-president, secretary, or treasurer) attesting that the director in

question is not required to undergo a criminal history record check because he or she is not an

owner of any controlling interest, financial or otherwise.

Information on how to initiate a criminal history record check will be provided by the Department

upon receipt of your registration application (Form DR-1S).

Florida Department of Revenue, Secondhand Dealers, Mail-in Secondhand Precious

Metals Dealers, and Secondary Metals Recyclers, Page 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5