Form F-1196 Draft - Allocation For Research And Development Tax Credit For Florida Corporate Income/franchise Tax Page 4

ADVERTISEMENT

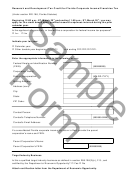

Federal Credit for Increasing Research Activities

Is the corporation planning to claim the federal credit for increasing research activities for its

qualified research expenses incurred during the prior calendar year? Yes

No

Indicate the corporation's total (including non-Florida) research expenses qualifying for the

federal credit for increasing research activities under s. 41, IRC, incurred during calendar

(January 1 – December 31).

year

(Enter whole dollar amount only.)

$

Tentative Allowable Amount of Credit

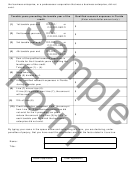

Lines (1) – (6): Compute the base amount as the average of the qualified research expenses in

Florida for the 4 taxable years preceding the taxable year for which the credit is determined. The

qualified research expenses taken into account in computing the base amount is determined on

a basis consistent with the determination of qualified research expenses for the taxable year.

The 4 taxable years used to compute the base amount must end before the calendar year for

which the qualified research expenses are determined. For example, the base years for

qualified research expenses incurred during calendar year 2017 should end in 2016, 2015,

2014, and 2013*. See table below:

1st taxable

2nd taxable

3rd taxable

4th taxable

Qualified

year ending

year ending

year ending

year ending

research

Tax year end

before the

before the

before the

before the

expenses in

taxable year

taxable year

taxable year

taxable year

Florida

of the credit

of the credit

of the credit

of the credit

12/31/2017

12/31/2016

12/31/2015

12/31/2014

12/31/2013

01/31/2018

01/31/2016

01/31/2015

01/31/2014

01/31/2013

02/29/2018

02/28/2016

02/28/2015

02/29/2014

02/28/2013

03/31/2018

03/31/2016

03/31/2015

03/31/2014

03/31/2013

04/30/2018

04/30/2016

04/30/2015

04/30/2014

04/30/2013

05/31/2018

1/1/2017-

05/31/2016

05/31/2015

05/31/2014

05/31/2013

12/31/2017

06/30/2018

06/30/2016

06/30/2015

06/30/2014

06/30/2013

07/31/2018

07/31/2016

07/31/2015

07/31/2014

07/31/2013

08/31/2018

08/31/2016

08/31/2015

08/31/2014

08/31/2013

09/30/2018

09/30/2016

09/30/2015

09/30/2014

09/30/2013

10/31/2018

10/31/2016

10/31/2015

10/31/2014

10/31/2013

11/30/2018

11/30/2016

11/30/2015

11/30/2014

11/30/2013

*If the corporation has any short years as part of the base calculation, include the corporation’s

taxable years.

Lines (7) – (10): Compute the credit allocation requested. The tax credit is 10 percent of the

qualified research expenses over the base amount. However, the maximum tax credit for a

business enterprise that has not been in existence for at least 4 taxable years immediately

preceding the taxable year of the credit is reduced by 25 percent for each taxable year for which

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5