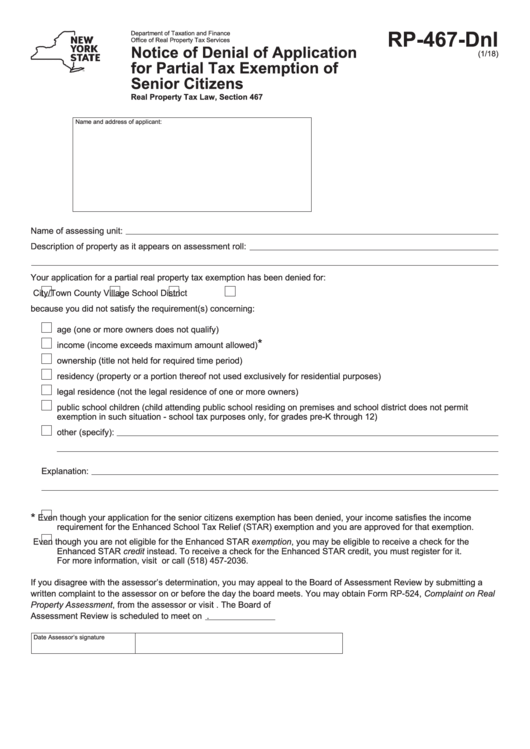

RP-467-Dnl

Department of Taxation and Finance

Office of Real Property Tax Services

Notice of Denial of Application

(1/18)

for Partial Tax Exemption of

Senior Citizens

Real Property Tax Law, Section 467

Name and address of applicant:

Name of assessing unit:

Description of property as it appears on assessment roll:

Your application for a partial real property tax exemption has been denied for:

City/Town

County

Village

School District

because you did not satisfy the requirement(s) concerning:

age (one or more owners does not qualify)

*

income (income exceeds maximum amount allowed)

ownership (title not held for required time period)

residency (property or a portion thereof not used exclusively for residential purposes)

legal residence (not the legal residence of one or more owners)

public school children (child attending public school residing on premises and school district does not permit

exemption in such situation - school tax purposes only, for grades pre-K through 12)

other (specify):

Explanation:

*

Even though your application for the senior citizens exemption has been denied, your income satisfies the income

requirement for the Enhanced School Tax Relief (STAR) exemption and you are approved for that exemption.

Even though you are not eligible for the Enhanced STAR exemption, you may be eligible to receive a check for the

Enhanced STAR credit instead. To receive a check for the Enhanced STAR credit, you must register for it.

For more information, visit or call (518) 457-2036.

If you disagree with the assessor’s determination, you may appeal to the Board of Assessment Review by submitting a

written complaint to the assessor on or before the day the board meets. You may obtain Form RP-524, Complaint on Real

Property Assessment, from the assessor or visit The Board of

Assessment Review is scheduled to meet on

.

Date

Assessor’s signature

1

1