Instructions For Form Rp-467-I - Application For The Partial Real Property Tax Exemption For Senior Citizens Exemption

ADVERTISEMENT

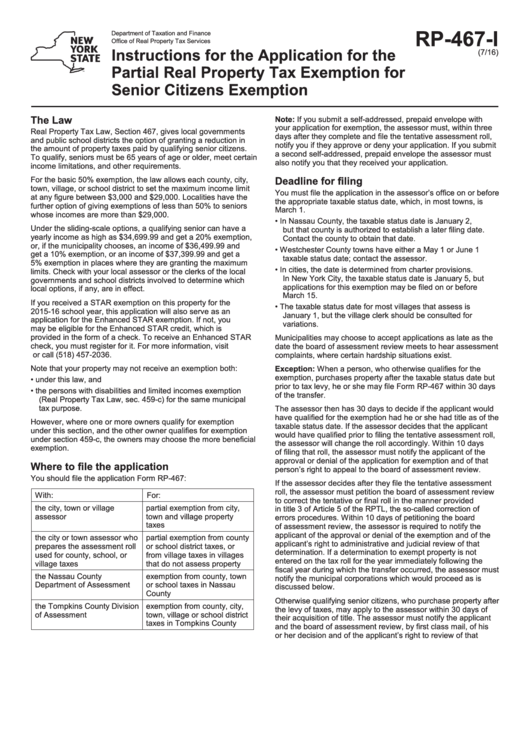

RP-467-I

Department of Taxation and Finance

Office of Real Property Tax Services

Instructions for the Application for the

(7/16)

Partial Real Property Tax Exemption for

Senior Citizens Exemption

The Law

Note: If you submit a self-addressed, prepaid envelope with

your application for exemption, the assessor must, within three

Real Property Tax Law, Section 467, gives local governments

days after they complete and file the tentative assessment roll,

and public school districts the option of granting a reduction in

notify you if they approve or deny your application. If you submit

the amount of property taxes paid by qualifying senior citizens.

a second self-addressed, prepaid envelope the assessor must

To qualify, seniors must be 65 years of age or older, meet certain

also notify you that they received your application.

income limitations, and other requirements.

For the basic 50% exemption, the law allows each county, city,

Deadline for filing

town, village, or school district to set the maximum income limit

You must file the application in the assessor’s office on or before

at any figure between $3,000 and $29,000. Localities have the

the appropriate taxable status date, which, in most towns, is

further option of giving exemptions of less than 50% to seniors

March 1.

whose incomes are more than $29,000.

• In Nassau County, the taxable status date is January 2,

Under the sliding-scale options, a qualifying senior can have a

but that county is authorized to establish a later filing date.

yearly income as high as $34,699.99 and get a 20% exemption,

Contact the county to obtain that date.

or, if the municipality chooses, an income of $36,499.99 and

• Westchester County towns have either a May 1 or June 1

get a 10% exemption, or an income of $37,399.99 and get a

taxable status date; contact the assessor.

5% exemption in places where they are granting the maximum

• In cities, the date is determined from charter provisions.

limits. Check with your local assessor or the clerks of the local

In New York City, the taxable status date is January 5, but

governments and school districts involved to determine which

applications for this exemption may be filed on or before

local options, if any, are in effect.

March 15.

If you received a STAR exemption on this property for the

• The taxable status date for most villages that assess is

2015-16 school year, this application will also serve as an

January 1, but the village clerk should be consulted for

application for the Enhanced STAR exemption. If not, you

variations.

may be eligible for the Enhanced STAR credit, which is

provided in the form of a check. To receive an Enhanced STAR

Municipalities may choose to accept applications as late as the

check, you must register for it. For more information, visit

date the board of assessment review meets to hear assessment

or call (518) 457-2036.

complaints, where certain hardship situations exist.

Note that your property may not receive an exemption both:

Exception: When a person, who otherwise qualifies for the

exemption, purchases property after the taxable status date but

• under this law, and

prior to tax levy, he or she may file Form RP-467 within 30 days

• the persons with disabilities and limited incomes exemption

of the transfer.

(Real Property Tax Law, sec. 459-c) for the same municipal

tax purpose.

The assessor then has 30 days to decide if the applicant would

have qualified for the exemption had he or she had title as of the

However, where one or more owners qualify for exemption

taxable status date. If the assessor decides that the applicant

under this section, and the other owner qualifies for exemption

would have qualified prior to filing the tentative assessment roll,

under section 459-c, the owners may choose the more beneficial

the assessor will change the roll accordingly. Within 10 days

exemption.

of filing that roll, the assessor must notify the applicant of the

approval or denial of the application for exemption and of that

Where to file the application

person’s right to appeal to the board of assessment review.

You should file the application Form RP-467:

If the assessor decides after they file the tentative assessment

roll, the assessor must petition the board of assessment review

With:

For:

to correct the tentative or final roll in the manner provided

the city, town or village

partial exemption from city,

in title 3 of Article 5 of the RPTL, the so-called correction of

assessor

town and village property

errors procedures. Within 10 days of petitioning the board

taxes

of assessment review, the assessor is required to notify the

applicant of the approval or denial of the exemption and of the

the city or town assessor who

partial exemption from county

applicant’s right to administrative and judicial review of that

prepares the assessment roll

or school district taxes, or

determination. If a determination to exempt property is not

used for county, school, or

from village taxes in villages

entered on the tax roll for the year immediately following the

village taxes

that do not assess property

fiscal year during which the transfer occurred, the assessor must

the Nassau County

exemption from county, town

notify the municipal corporations which would proceed as is

Department of Assessment

or school taxes in Nassau

discussed below.

County

Otherwise qualifying senior citizens, who purchase property after

the Tompkins County Division

exemption from county, city,

the levy of taxes, may apply to the assessor within 30 days of

of Assessment

town, village or school district

their acquisition of title. The assessor must notify the applicant

taxes in Tompkins County

and the board of assessment review, by first class mail, of his

or her decision and of the applicant’s right to review of that

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3

![Instructions For Form Rp-421-i-ins [buffalo] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities Instructions For Form Rp-421-i-ins [buffalo] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities](https://data.formsbank.com/pdf_docs_html/362/3622/362242/page_1_thumb.png)

![Instructions For Form Rp-421-i-ins [albany] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities Instructions For Form Rp-421-i-ins [albany] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities](https://data.formsbank.com/pdf_docs_html/362/3622/362247/page_1_thumb.png)