Instructions For Form Rp-305-Pr-Ins - Agricultural Payment Report

ADVERTISEMENT

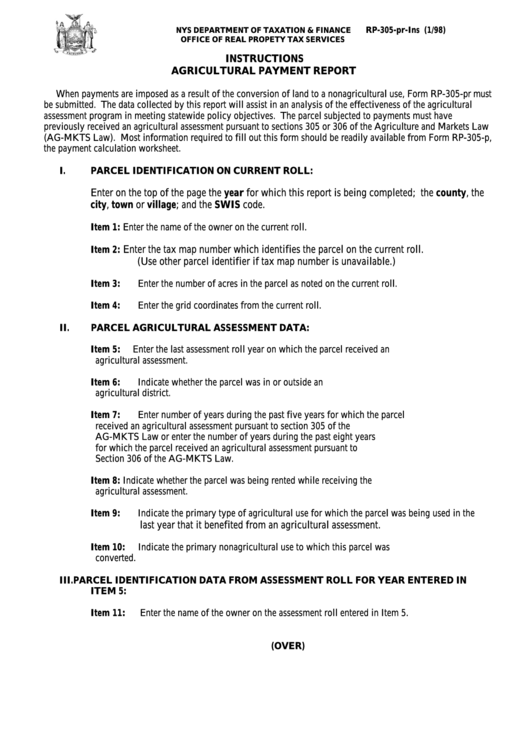

RP-305-pr-Ins (1/98)

NYS DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPETY TAX SERVICES

INSTRUCTIONS

AGRICULTURAL PAYMENT REPORT

When payments are imposed as a result of the conversion of land to a nonagricultural use, Form RP-305-pr must

be submitted. The data collected by this report will assist in an analysis of the effectiveness of the agricultural

assessment program in meeting statewide policy objectives. The parcel subjected to payments must have

previously received an agricultural assessment pursuant to sections 305 or 306 of the Agriculture and Markets Law

(AG-MKTS Law). Most information required to fill out this form should be readily available from Form RP-305-p,

the payment calculation worksheet.

I.

PARCEL IDENTIFICATION ON CURRENT ROLL:

Enter on the top of the page the year for which this report is being completed; the county, the

city, town or village; and the SWIS code.

Item 1:

Enter the name of the owner on the current roll.

Enter the tax map number which identifies the parcel on the current roll.

Item 2:

(Use other parcel identifier if tax map number is unavailable.)

Item 3:

Enter the number of acres in the parcel as noted on the current roll.

Item 4:

Enter the grid coordinates from the current roll.

II.

PARCEL AGRICULTURAL ASSESSMENT DATA:

Item 5:

Enter the last assessment roll year on which the parcel received an

agricultural assessment.

Item 6:

Indicate whether the parcel was in or outside an

agricultural district.

Item 7:

Enter number of years during the past five years for which the parcel

received an agricultural assessment pursuant to section 305 of the

AG-MKTS Law or enter the number of years during the past eight years

for which the parcel received an agricultural assessment pursuant to

Section 306 of the AG-MKTS Law.

Item 8:

Indicate whether the parcel was being rented while receiving the

agricultural assessment.

Item 9:

Indicate the primary type of agricultural use for which the parcel was being used in the

last year that it benefited from an agricultural assessment.

Item 10:

Indicate the primary nonagricultural use to which this parcel was

converted.

III.

PARCEL IDENTIFICATION DATA FROM ASSESSMENT ROLL FOR YEAR ENTERED IN

ITEM 5:

Item 11:

Enter the name of the owner on the assessment roll entered in Item 5.

(OVER)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2

![Instructions For Form Rp-421-j-ins [cohoes] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities Instructions For Form Rp-421-j-ins [cohoes] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities](https://data.formsbank.com/pdf_docs_html/362/3622/362237/page_1_thumb.png)

![Instructions For Form Rp-421-i-ins [buffalo] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities Instructions For Form Rp-421-i-ins [buffalo] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities](https://data.formsbank.com/pdf_docs_html/362/3622/362242/page_1_thumb.png)

![Instructions For Form Rp-421-i-ins [albany] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities Instructions For Form Rp-421-i-ins [albany] - Application For Real Property Tax Exemption For Capital Improvements To Multiple Dwelling Buildings Within Certain Cities](https://data.formsbank.com/pdf_docs_html/362/3622/362247/page_1_thumb.png)