Instructions For Form 8940 - Request For Miscellaneous Determination Under Section 507, 509(A), 4940, 4942, 4945, And 6033 Of The Internal Revenue Code Page 3

ADVERTISEMENT

are requesting an exception from filing

a convention or association of churches,

affiliated with a governmental unit, please

Form 990, Form 990-EZ, Short Form of

please review Regulations section

review Rev. Proc. 95-48, 1995-2 C.B. 418.

Organization Exempt From Income Tax, or

1.6033-2(g) and (h) and Rev. Proc. 96-10,

Indicate under which exception, as

Form 990-N (e-Postcard).

1996-1 C.B. 577.

listed in Table 1, you believe you qualify

If you believe you should be exempt

If you believe you should be exempt

for exemption from filing, and submit the

from filing Form 990 or Form 990-EZ

from filing Form 990 or Form 990-EZ

appropriate information.

because you are affiliated with a church or

because you are a governmental unit or

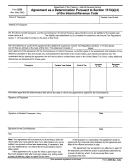

Table 1. Exception from Form 990 Filing Requirements

Organization

Documentation required to support the exemption

A church, an interchurch organization of local

If you are requesting reclassification as a church, an interchurch organization of local units of a church, or a

units of a church, a convention or association

convention or association of churches, please refer to the instructions listed in Line 8g. Reclassification of

of churches.

foundation status for a church or convention or association of churches.

An integrated auxiliary of a church described in

Submit documentation that you are described both in sections 501(c)(3) and 509(a)(1), (2), or (3).

Regulations section 1.6033-2(h) (such as a

Submit documentation, one of the three items listed below, showing that you are affiliated with a church or

men’s or women’s organization, religious

a convention or association of churches, as detailed in Regulations section 1.6033-2(h)(2).

school, mission society, or religious group).

1.

Submit documentation indicating whether you are covered by a group exemption letter issued under

applicable administrative procedures (see Rev. Proc. 80-27, 1980-1 C.B. 677 and Regulations section

601.601(a)(2)(ii)(b)) to a church or a convention or association of churches;

2.

Submit documentation from your bylaws or other organizational documents that states whether the

affiliated church has the authority to appoint and remove your directors, as this will document that you are

operated, supervised, or controlled by or in connection with (as defined in Regulations section 1.509(a)-4) a

church or a convention or association of churches; or

3.

Submit supporting documentation to detail how relevant facts and circumstances show that you are

affiliated with a church or a convention or association of churches, as detailed in Regulations section

1.6033-2(h)(3).

Submit documentation, both of the items listed below, detailing whether or not you are internally

supported, as detailed in Regulations section 1.6033-2(h)(4).

1.

State whether you offer admissions, goods, services or facilities for sale, other than on an incidental

basis, to the general public (except goods, services, or facilities sold at a nominal charge or for an

insubstantial portion of the cost); and

2.

Submit documentation detailing whether you normally receive more than 50% of your support from a

combination of governmental sources, public solicitation of contributions, and receipts from the sale of

admissions, goods, performance of services, or furnishing of facilities in activities that are not unrelated trades

or businesses.

Note. Men's or women's organizations, seminaries, mission societies, and youth groups do not need to meet

the internal support requirement.

A church-affiliated organization (other than a

Submit documentation detailing your fund management, financing, or retirement insurance program(s)

section 509(a)(3) organization) that is

primarily for organizations described in sections 509(a)(1) and 170(b)(1)(A)(i).

exclusively engaged in managing funds or

Submit documentation indicating whether more than 50% of the individuals covered by the program(s) are

maintaining retirement programs and is

directly employed by those organizations, or documentation indicating whether more than 50% of the assets

described in Rev. Proc. 96-10, 1996-1 C.B. 577.

are contributed by, or held for the benefit of, employees of those organizations.

A school below college level affiliated with a

Refer to the instructions for an integrated auxiliary of a church described in Regulations section

church or operated by a religious order

1.6033-2(h).

described in Regulations section 1.6033-2(g)(1)

Note. A school below college level affiliated with a church or operated by a religious order does not have to

(vii).

submit documentation detailing whether or not it is internally supported.

A mission society (other than a section 509(a)

Submit documentation that you are described in section 501(c)(3) and section 509(a)(1) or (2).

(3) supporting organization) sponsored by, or

Submit documentation detailing that more than half of your activities are conducted in, or directed at,

affiliated with, one or more churches or church

persons in foreign countries.

denominations, if more than half of the society’s

Submit documentation that you are sponsored by or affiliated with one or more churches or church

activities are conducted in, or directed at,

denominations.

persons in foreign countries.

• Submit bylaws or other organizational documents showing that a majority of your officers, directors, or

trustees (i) are appointed or elected by churches or church denominations, or (ii) also serve in such

capacity with churches or church denominations.

• Submit documentation to detail how relevant facts and circumstances show that you are affiliated with

one or more churches or church denominations. See Regulations section 1.6033-2(h) for guidance.

A state institution (other than a section 509(a)

Submit a copy of the ruling letter from the IRS stating that your income, derived from activities constituting the

(3) supporting organization) whose income is

basis for its exemption under section 501(c), is excluded from gross income under section 115.

excluded from gross income under section 115.

Instructions for Form 8940 (2018)

-3-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8