Form Mc 008 - Qualified Medicare Beneficiary Program Information Notice Page 2

ADVERTISEMENT

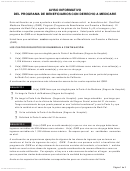

I. Fill in the MONTHLY amounts for the person who wants to be a QMB.

1. Social Security check

$

2. VA benefits

$

3. Interest from bank accounts or certificates of deposits

$

4. Retirement Income

$

5. Any other Income

$

6. Total—add lines 1 through 5

$

II. If you are married and living with your spouse, complete the following MONTHLY

amounts for your spouse even if this spouse also wants to be a QMB.

7. Social Security check

$

8. VA benefits

$

9. Interest from bank accounts or certificates of deposit

$

10. Retirement Income

$

11. Any Other Income

$

12. Total—add lines 7 through 11

$

II. Fill in the MONTHLY amounts for the person in I, and if married, the spouse in II.

13. Gross earnings for the person who wants to be a QMB

$

14. Gross earnings for the spouse

$

15. Total—add lines 13 and 14

$

16. Subtract $65

$ –

65

17. Remainder

$

18. Divide by 2

$

19. Total—add lines 6, 12, and 18

*$

* If you are not married, this tot al cannot exceed $ 908. If you are married and living with your

spouse, this total cannot exceed $ 1,226. However, if you have children or your spouse has

low income, this tot al may be higher. If you received a Title II Social Security cost of

living adjustment, this amount will not be counted until April.

Page 2 of 3

MC 008 Information Notice (10/11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3