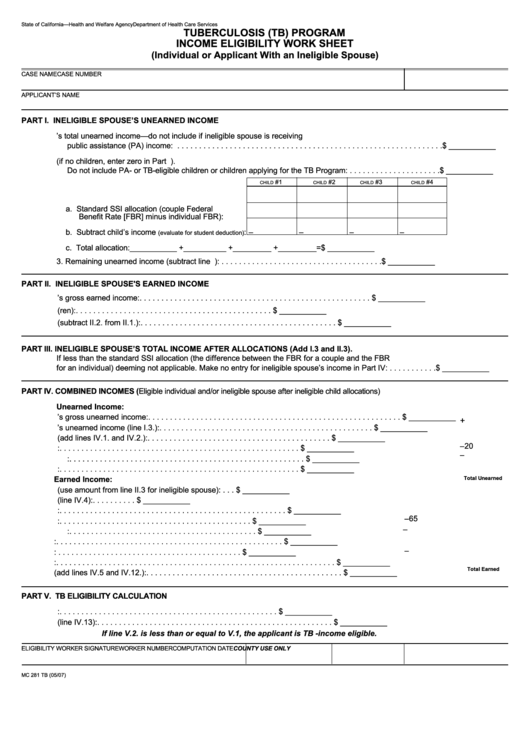

State of California—Health and Welfare Agency

Department of Health Care Services

TUBERCULOSIS (TB) PROGRAM

INCOME ELIGIBILITY WORK SHEET

(Individual or Applicant With an Ineligible Spouse)

CASE NAME

CASE NUMBER

APPLICANT’S NAME

PART I. INELIGIBLE SPOUSE’S UNEARNED INCOME

1. Ineligible spouse’s total unearned income—do not include if ineligible spouse is receiving

public assistance (PA) income: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ___________

2. Allocation for ineligible children (if no children, enter zero in Part 1.2.c.).

Do not include PA- or TB-eligible children or children applying for the TB Program: . . . . . . . . . . . . . . . . . . . . .

$ ___________

#1

#2

#3

#4

CHILD

CHILD

CHILD

CHILD

a. Standard SSI allocation (couple Federal

Benefit Rate [FBR] minus individual FBR):

b. Subtract child’s income

:

–

–

–

–

(evaluate for student deduction)

c. Total allocation:

___________ +__________ + _________ + _________ = $ ___________

3. Remaining unearned income (subtract line I.2.c. from line I.1.): . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ ___________

PART II. INELIGIBLE SPOUSE'S EARNED INCOME

1. Ineligible spouse’s gross earned income: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ___________

2. Unused portion of allocation for ineligible child(ren): . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ___________

3. Remaining earned income (subtract II.2. from II.1.): . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ___________

PART III. INELIGIBLE SPOUSE’S TOTAL INCOME AFTER ALLOCATIONS (Add I.3 and II.3).

If less than the standard SSI allocation (the difference between the FBR for a couple and the FBR

for an individual) deeming not applicable. Make no entry for ineligible spouse’s income in Part IV: . . . . . . . . . . .

$ ___________

PART IV. COMBINED INCOMES (Eligible individual and/or ineligible spouse after ineligible child allocations)

Unearned Income:

1. Applicant’s gross unearned income:. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ___________

+

2. Ineligible spouse’s unearned income (line I.3.): . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ___________

3. Combined unearned income (add lines IV.1. and IV.2.): . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ___________

–20

4. A. Subtract general income exclusion: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ___________

–

B. Subtract other unearned deductions: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ___________

5. Combined countable unearned income:. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ___________

Total Unearned

Earned Income:

6. Earned income of applicant and spouse (use amount from line II.3 for ineligible spouse): . . .

$ ___________

7. Subtract balance of general exclusion not offset by unearned income (line IV.4):. . . . . . . . . .

$ ___________

8. Remaining earned income:. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ___________

–65

9. A. Subtract work expense exclusion:. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ___________

–

B. Subtract other earned deductions: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ___________

10. Remaining earned income:. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ___________

–

11. Subtract 1/2 remaining earned income: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ___________

12. Countable earned income: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ___________

Total Earned

13. Total countable income (add lines IV.5 and IV.12.): . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ___________

PART V. TB ELIGIBILITY CALCULATION

1. Current TB income standard for an individual: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ___________

2. Enter total countable income (line IV.13):. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ___________

If line V.2. is less than or equal to V.1, the applicant is TB -income eligible.

COUNTY USE ONLY

ELIGIBILITY WORKER SIGNATURE

WORKER NUMBER

COMPUTATION DATE

MC 281 TB (05/07)

1

1 2

2