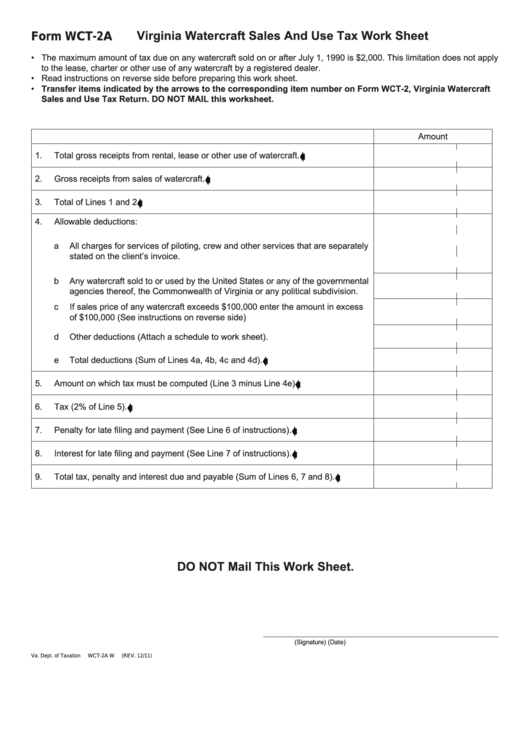

Virginia Watercraft Sales And Use Tax Work Sheet

Form WCT-2A

• The maximum amount of tax due on any watercraft sold on or after July 1, 1990 is $2,000. This limitation does not apply

to the lease, charter or other use of any watercraft by a registered dealer.

• Read instructions on reverse side before preparing this work sheet.

• Transfer items indicated by the arrows to the corresponding item number on Form WCT-2, Virginia Watercraft

Sales and Use Tax Return. Do NoT mAil this worksheet.

Amount

1.

Total gross receipts from rental, lease or other use of watercraft.

s

2.

Gross receipts from sales of watercraft.

s

3.

Total of Lines 1 and 2

s

4.

Allowable deductions:

a All charges for services of piloting, crew and other services that are separately

stated on the client’s invoice.

b Any watercraft sold to or used by the United States or any of the governmental

agencies thereof, the Commonwealth of Virginia or any political subdivision.

c If sales price of any watercraft exceeds $100,000 enter the amount in excess

of $100,000 (See instructions on reverse side)

d Other deductions (Attach a schedule to work sheet).

e Total deductions (Sum of Lines 4a, 4b, 4c and 4d).

s

5.

Amount on which tax must be computed (Line 3 minus Line 4e)

s

6.

Tax (2% of Line 5).

s

7.

Penalty for late filing and payment (See Line 6 of instructions).

s

8.

Interest for late filing and payment (See Line 7 of instructions).

s

9.

Total tax, penalty and interest due and payable (Sum of Lines 6, 7 and 8).

s

Do NoT mail This Work Sheet.

(Signature)

(Date)

Va. Dept. of Taxation

WCT-2A W

(REV. 12/11)

1

1 2

2