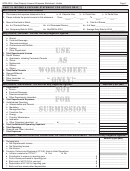

Form Rpie-2016 - Real Property Income And Expense Worksheet And Instructions For Hotels Page 4

ADVERTISEMENT

Instructions for Worksheet RPIE-2016 - Hotels

Page 3

Please note that consolidated lot filings are not available for the following specialty property types: adult

care/nursing home facilities, gas stations, car washes, oil change facilities, self-storage, theatres or con-

cert halls.

If your properties meet all the above criteria and you want to submit a consolidated filing, allocate the

properties’ income and expense using either square footage or number of units. Select allocations by a

percentage of income to each lot only if square feet or number of units is inappropriate for allocating your

properties’ income and expense.

sECtIoN D - RPIE EXCLUsIoNs

If you are identified as a required RPIE-2016 filer, you will need to complete an income and expense form

or complete a claim of exclusion in Section D. If your property is income-producing and eligible to claim

an RPIE exclusion, please identify one of the exclusions listed in the section below.

Exclusions include:

a.

Actual AV (Assessed Value) as shown on the Tentative Assessment Roll 2017-2018 is $40,000

or less.

b.

The property is both exclusively residential and has 10 or fewer apartments, including both va-

cant and occupied units.

c.

The property has both six or fewer residential units and no more than one commercial unit. Your

property must be in Tax Class 1 or Tax Class 2 and the unit count must include all units whether

vacant or occupied. For example, if your property has five residential and two commercial units,

you must file an RPIE because you have two commercial units.

d.

Residential cooperative apartment buildings with no more than 2,500 square feet of commercial

space (not including garage space). To claim this exclusion you must still complete the RPIE-2016

(Parts I and IV). An RPIE is required for unsold sponsor-owned units if 10% or more of the units

remain unsold.

e.

Individual residential units in a condominium building/development. For a residential condo-

minium that has commercial space, professional space, and/or has 10% or more unsold spon-

sor-owned units, an RPIE must be filed for the commercial space, professional space or the

unsold sponsor-owned units. An RPIE must also be filed for residential units that are rentals and

not intended to be individually owned.

f.

If rented exclusively to a person or entity related to the owner:

Business entities under common control.

●

Fiduciaries and the beneficiaries for whom they act.

●

Spouse, parents, children, siblings and parents in-law.

●

Owner-controlled business entities.

●

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20