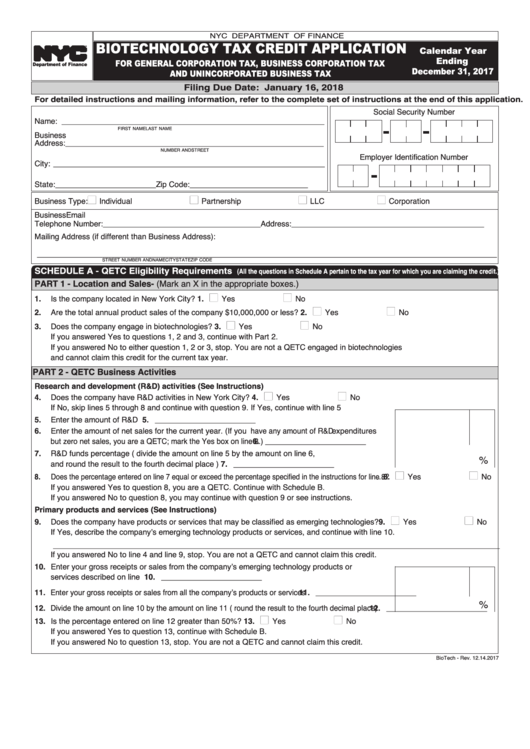

Biotechnology Tax Credit Application - New York Department Of Finance

ADVERTISEMENT

N Y C d E p a r t m E N t o f f I N a N C E

BIOTECHNOLOGY TAX CREDIT APPLICATION

Calendar Year

TM

Ending

FOR GENERAL CORPORATION TAX, BUSINESS CORPORATION TAX

Department of Finance

December 31, 2017

AND UNINCORPORATED BUSINESS TAX

Filing Due Date: January 16, 2018

For detailed instructions and mailing information, refer to the complete set of instructions at the end of this application.

Social Security Number

Name: ____________________________________________________________

fIrSt NamE

laSt NamE

Business

address: ___________________________________________________________

NumBEr aNd StrEEt

Employer Identification Number

City: ______________________________________________________________

State: _______________________ Zip Code: ___________________________

n

n

n

n

Business type:

Individual

partnership

llC

Corporation

Business

Email

telephone Number: ____________________________________ address: ____________________________________________

mailing address (if different than Business address):

_________________________________________________________________________________________________________

StrEEt NumBEr aNd NamE

CItY

StatE

ZIp CodE

SCHEDULE A - QETC Eligibility Requirements

(All the questions in Schedule A pertain to the tax year for which you are claiming the credit.)

PART 1 - Location and Sales - (mark an X in the appropriate boxes.)

n

n

1.

Is the company located in New York City? ......................................................................................1.

Yes

No

n

n

2.

are the total annual product sales of the company $10,000,000 or less? ......................................2.

Yes

No

n

n

3.

does the company engage in biotechnologies? ............................................................................3.

Yes

No

If you answered Yes to questions 1, 2 and 3, continue with part 2.

If you answered No to either question 1, 2 or 3, stop. You are not a QEtC engaged in biotechnologies

and cannot claim this credit for the current tax year.

PART 2 - QETC Business Activities

Research and development (R&D) activities (See Instructions)

4.

n

n

does the company have r&d activities in New York City?.............................................................4.

Yes

No

If No, skip lines 5 through 8 and continue with question 9. If Yes, continue with line 5

5.

Enter the amount of r&d expenditures...........................................................................................5. _______________________

6.

Enter the amount of net sales for the current year. (If you have any amount of r&d expenditures

but zero net sales, you are a QEtC; mark the Yes box on line 8.)............................................................6. _______________________

7.

r&d funds percentage ( divide the amount on line 5 by the amount on line 6,

%

and round the result to the fourth decimal place )...........................................................................7. _______________________

8.

n

n

does the percentage entered on line 7 equal or exceed the percentage specified in the instructions for line 8? ...8.

Yes

No

If you answered Yes to question 8, you are a QEtC. Continue with Schedule B.

If you answered No to question 8, you may continue with question 9 or see instructions.

Primary products and services (See Instructions)

9.

does the company have products or services that may be classified as emerging technologies? 9.

n

n

Yes

No

If Yes, describe the company’s emerging technology products or services, and continue with line 10.

______________________________________________________________________________________________________

If you answered No to line 4 and line 9, stop. You are not a QEtC and cannot claim this credit.

10. Enter your gross receipts or sales from the company’s emerging technology products or

services described on line 9 ..........................................................................................................10. _______________________

11. Enter your gross receipts or sales from all the company’s products or services.....................................11. _______________________

%

12. divide the amount on line 10 by the amount on line 11 ( round the result to the fourth decimal place) ....12. _______________________

13. Is the percentage entered on line 12 greater than 50%? ..............................................................13.

n

n

Yes

No

If you answered Yes to question 13, continue with Schedule B.

If you answered No to question 13, stop. You are not a QEtC and cannot claim this credit.

Biotech - rev. 12.14.2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8