Form Nyc-Nold-Gct - Net Operating Loss Deduction Computation General Corporation Tax - 2017

ADVERTISEMENT

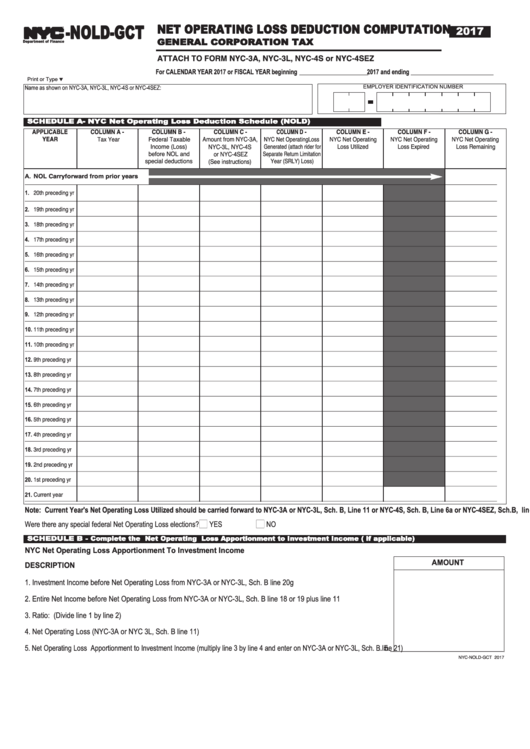

-NOLD-GCT

NET OPERATING LOSS DEDUCTION COMPUTATION

2017

TM

GENERAL CORPORATION TAX

Department of Finance

ATTACH TO FORM NYC-3A, NYC-3L, NYC-4S or NYC-4SEZ

For CALENDAR YEAR 2017 or FISCAL YEAR beginning ____________________ 2017 and ending ________________________

Print or Type

t

Name as shown on NYC-3A, NYC-3L, NYC-4S or NYC-4SEZ:

EMPLOYER IDENTIFICATION NUMBER

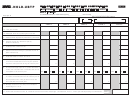

SCHEDULE A - NYC Net Operating Loss Deduction Schedule (NOLD)

APPLICABLE

COLUMN A -

COLUMN B -

COLUMN C -

COLUMN D -

COLUMN E -

COLUMN F -

COLUMN G -

YEAR

Amount from NYC-3A,

Tax Year

Federal Taxable

NYC Net Operating Loss

NYC Net Operating

NYC Net Operating

NYC Net Operating

Income (Loss)

NYC-3L, NYC-4S

Generated (attach rider for

Loss Utilized

Loss Expired

Loss Remaining

before NOL and

or NYC-4SEZ

Separate Return Limitation

special deductions

(See instructions)

Year (SRLY) Loss)

A. NOL Carryforward from prior years

___________________________________________________________________________________________________________________________________________________________________

1. 20th preceding yr

___________________________________________________________________________________________________________________________________________________________________

2. 19th preceding yr

___________________________________________________________________________________________________________________________________________________________________

3. 18th preceding yr

___________________________________________________________________________________________________________________________________________________________________

4. 17th preceding yr

___________________________________________________________________________________________________________________________________________________________________

5. 16th preceding yr

___________________________________________________________________________________________________________________________________________________________________

6. 15th preceding yr

___________________________________________________________________________________________________________________________________________________________________

7. 14th preceding yr

___________________________________________________________________________________________________________________________________________________________________

8. 13th preceding yr

___________________________________________________________________________________________________________________________________________________________________

9. 12th preceding yr

___________________________________________________________________________________________________________________________________________________________________

10. 11th preceding yr

___________________________________________________________________________________________________________________________________________________________________

11. 10th preceding yr

___________________________________________________________________________________________________________________________________________________________________

12. 9th preceding yr

___________________________________________________________________________________________________________________________________________________________________

13. 8th preceding yr

___________________________________________________________________________________________________________________________________________________________________

14. 7th preceding yr

___________________________________________________________________________________________________________________________________________________________________

15. 6th preceding yr

___________________________________________________________________________________________________________________________________________________________________

16. 5th preceding yr

___________________________________________________________________________________________________________________________________________________________________

17. 4th preceding yr

___________________________________________________________________________________________________________________________________________________________________

18. 3rd preceding yr

___________________________________________________________________________________________________________________________________________________________________

19. 2nd preceding yr

___________________________________________________________________________________________________________________________________________________________________

20. 1st preceding yr

___________________________________________________________________________________________________________________________________________________________________

21. Current year

___________________________________________________________________________________________________________________________________________________________________

Note: Current Year's Net Operating Loss Utilized should be carried forward to NYC-3A or NYC-3L, Sch. B, Line 11 or NYC-4S, Sch. B, Line 6a or NYC-4SEZ, Sch.B, line 4.

Were there any special federal Net Operating Loss elections?................................................................................................................

YES

NO

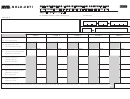

SCHEDULE B - Complete the Net Operating Loss Apportionment to Investment Income ( if applicable)

NYC Net Operating Loss Apportionment To Investment Income

AMOUNT

DESCRIPTION

1. Investment Income before Net Operating Loss from NYC-3A or NYC-3L, Sch. B line 20g........................................... 1.___________________________

2. Entire Net Income before Net Operating Loss from NYC-3A or NYC-3L, Sch. B line 18 or 19 plus line 11..................... 2.___________________________

3. Ratio: (Divide line 1 by line 2)............................................................................................................................... 3.___________________________

4. Net Operating Loss (NYC-3A or NYC 3L, Sch. B line 11).......................................................................................... 4.___________________________

5. Net Operating Loss Apportionment to Investment Income (multiply line 3 by line 4 and enter on NYC-3A or NYC-3L, Sch. B line 21).. 5.___________________________

NYC-NOLD-GCT 2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2