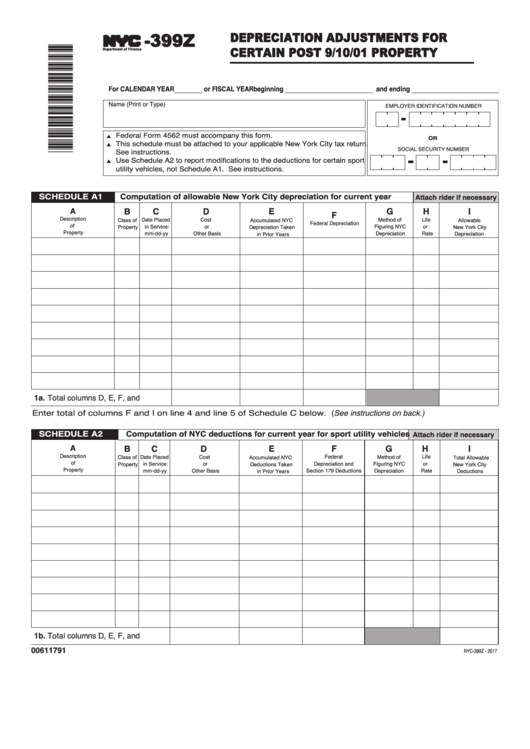

Form Nyc-399z - Depreciation Adjustments For Certain Post 9/10/01 Property

ADVERTISEMENT

-399Z

DEPRECIATION ADJUSTMENTS FOR

CERTAIN POST 9/10/01 PROPERTY

TM

Department of Finance

For CALENDAR YEAR ________ or FISCAL YEAR beginning _________________________ and ending _________________________

Name (Print or Type)

EMPLOYER IDENTIFICATION NUMBER

Federal Form 4562 must accompany this form.

OR

s

This schedule must be attached to your applicable New York City tax return.

s

See instructions.

SOCIAL SECURITY NUMBER

Use Schedule A2 to report modifications to the deductions for certain sport

s

utility vehicles, not Schedule A1. See instructions.

SCHEDULE A1

Computation of allowable New York City depreciation for current year

Attach rider if necessary

G

H

I

B

C

D

E

A

F

Description

Date Placed

Cost

Method of

Life

Class of

Accumulated NYC

Allowable

Federal Depreciation

of

Figuring NYC

or

Property

in Service:

or

Depreciation Taken

New York City

Property

Depreciation

Rate

mm-dd-yy

Other Basis

Depreciation

in Prior Years

1a. Total columns D, E, F, and I ...........

Enter total of columns F and I on line 4 and line 5 of Schedule C below. (See instructions on back.)

SCHEDULE A2

Computation of NYC deductions for current year for sport utility vehicles

Attach rider if necessary

B

C

D

E

F

G

H

I

A

Description

Date Placed

Cost

Federal

Method of

Life

Class of

Accumulated NYC

Total Allowable

of

in Service:

or

Depreciation and

Figuring NYC

or

Property

Deductions Taken

New York City

Property

mm-dd-yy

Other Basis

Section 179 Deductions

Depreciation

Rate

Deductions

in Prior Years

1b. Total columns D, E, F, and I ..........

00611791

NYC-399Z - 2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5