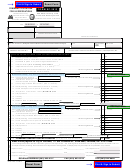

Form Nyc-1a - Combined Tax Return For Banking Corporations - 2017 Page 2

ADVERTISEMENT

Form NyC-1A 2017

Page 2

If more than one Page 2 is used,

NAME OF

NAME OF PRINCIPAL

NAME OF

PARENT

bANKINg subsIDIARy

subsIDIARy #2

please state total number of Page 2 attached: ___________

Employer Identification Number

Employer Identification Number

Employer Identification Number

SCHEDULE J - Computation of Combined Allocation Percentages

n

n

Yes

No

u Are you a banking corporation described in Administrative Code section 11-640(a)(9)?....................................................................................................

u Are you substantially engaged in providing management, administrative, or distribution services to an investment company as such terms

n

n

Yes

No

are defined in Administrative Code section 11-642(b)(1-a)?...............................................................................................................................................

If you answered “Yes” to both questions, then you must allocate using weighted factors

(see instructions concerning “Weighted Factor Allocation for Certain Banking Corporations.”)

Part 1 -

Computation of combined entire net income allocation percentage

1.

New York City wages (Form NYC-1, Sch. G, part 1, col. A, line 1a)

1.

..................

2.

Multiply column C, line 1 by 80%

......................................................................................................................

3.

Total wages (Form NYC-1, Sch. G, part 1, col. B, line 1a)

3.

...........................................

Percentage in New York City (col. C, line 2 ÷ col. C, line 3)

4.

..............................................

5.

New York City receipts (Form NYC-1, Sch. G, part 1, col. A, line 2l)

5.

................

6.

Total receipts (Form NYC-1, Sch. G, part 1, col. B, line 2l)

6.

.........................................

Percentage in New York City (col. C, line 5 ÷ col. C, line 6)

7.

..............................................

Additional receipts factor. Enter % from line 7. (see instructions on weighted factor allocation)

8.

9.

Deposits maintained at NYC branches

(Form NYC-1, Sch. G, part 1, col. A, line 4c)

9.

...............................................................................

10.

Total deposits (Form NYC-1, Sch. G, part 1, col. B, line 4c)

10.

...................................

11.

Percentage in New York City (col. C, line 9 ÷ col. C, line 10)

..........................................

12.

Additional deposits factor. Enter % from line 11. (See instructions on weighted factor allocation)

13.

Total of NYC percentages shown on lines 4, 7, 8, 11 and 12. (See instructions on weighted factor allocation)

- Divide line 13 by 5 or by the actual number of percentages if less than 5 and round to the nearest one hundredth of a percentage point

14.

COMbINED ENTIRE NET INCOME ALLOCATION PERCENTAgE

Part 2 -

Computation of combined alternative entire net income allocation percentage

15. New York City wages (Form NYC-1, Sch. G, part 2, col. A, line 1a)

15.

...............

16. Total wages (Form NYC-1, Sch. G, part 2, col. B, line 1a)

16.

........................................

17. Percentage in New York City (col. C, line 15 ÷ col. C, line 16)

.......................................

18. Combined receipts factor (Sch. J, col. C, line 7)

............................................................................

19. Combined deposits factor (Sch. J, col. C, line 11)

.........................................................................

20. Total of NYC percentages shown on lines 17, 18 and 19

.....................................................................................................................................

21.

- Divide line 20 by 3 or by the actual number of percentages if less than 3 and round to the nearest one hundredth of a percentage point

COMbINED ALTERNATIvE ENTIRE NET ALLOCATION PERCENTAgE

Part 3 -

Computation of combined taxable assets allocation percentage

22. New York City wages (Form NYC-1, Sch. G, part 3, col. A, line 1a)

22.

...............

23 Multiply Column C, line 22 by 80%

............................................................................................................................

24. Total wages (Form NYC-1, Sch. G, part 3, col. B, line 1a)

24.

........................................

25. Percentage in New York City (col. C, line 23 ÷ col. C, line 24)

.........

26. New York City receipts

26.

(Form NYC-1, Sch. G, part 3, col. A, line 2l)...

27. Total receipts (Form NYC-1, Sch. G, part 3, col. B, line 2l)

27.

..............

28. Percentage in New York City (col. C, line 26 ÷ col. C, line 27)

...............

29. Additional receipts factor. Enter % from line 28. (See instructions on weighted factor allocation)

30. Deposits maintained at NYC branches (Form NYC-1,

Sch. G, part 3, col. A, line 4c)

30.

...................................................................

31. Total deposits (Form NYC-1, Sch. G, part 3, col. B, line 4c)

31.

.........

32. Percentage in New York City (col. C, line 30 ÷ col. C, line 31)

...............

33. Additional deposits factor. Enter % from line 32. (See instructions on weighted factor allocation)

34. Total of NYC percentages shown on lines 25, 28, 29, 32 and 33. (See instructions on weighted factor allocation)

35.

- Divide line 34 by 5 or by the actual number of percentages if less than 5 and round to the nearest one hundredth of a percentage point

COMbINED TAxAbLE AssETs ALLOCATION PERCENTAgE

10121791

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8